The two most important concepts in futures trading are basis and convergence.

Basis

The relationship between the cash and futures price is known as the basis. In marketing, basis generally refers to the difference between a price in a particular cash market and a specific futures contract price.

Understanding the basis makes it possible to compare futures market price quotes with cash and forward contract price quotes.

The basic features of the basis are:

- Basis is defined as the difference between cash and futures prices: Basis = Cash prices – Future prices.

- Basis can be either positive or negative (in index futures, the basis generally is negative).

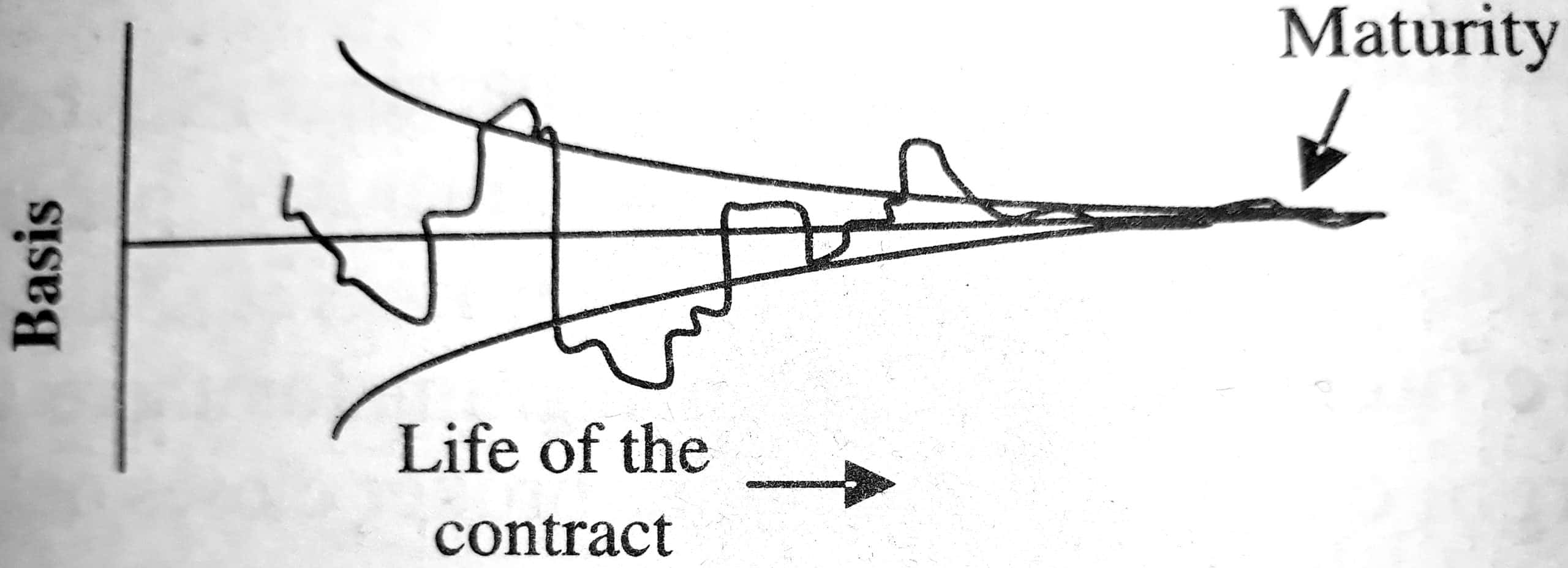

- Basis may change its sign several times during the life of the contract.

- Basis turns to zero at maturity of the futures contract, i.e., both cash and futures prices converge at maturity.

The basis is typically measured against the nearest futures month after a cash transaction.

For example, cash from transactions occurring in March will be measured against the May futures price; a forward price for November will be matched to the December futures, etc.

The basis measures local supply-and-demand conditions relative to the futures delivery region.

The basis in regions with surplus production will have a more negative basis (or less positive); in deficit production regions, the basis will be more positive (or less negative).

Many factors can influence the basis, including notable changes in local supply-and-demand balance and transportation costs. Basis also represents the portion of price risk that cannot be mitigated by hedging.

Convergence

The price basis between a currency derivative, such as forward or futures contracts, and spot currency equals the interest rate differential.

The forward rate moves toward the spot over time as the remaining amount of interest diminishes.

Thus, in any forward versus spot market, the passage of time wrings out the basis – the difference in interest rate values — as the derivative moves toward its value date.

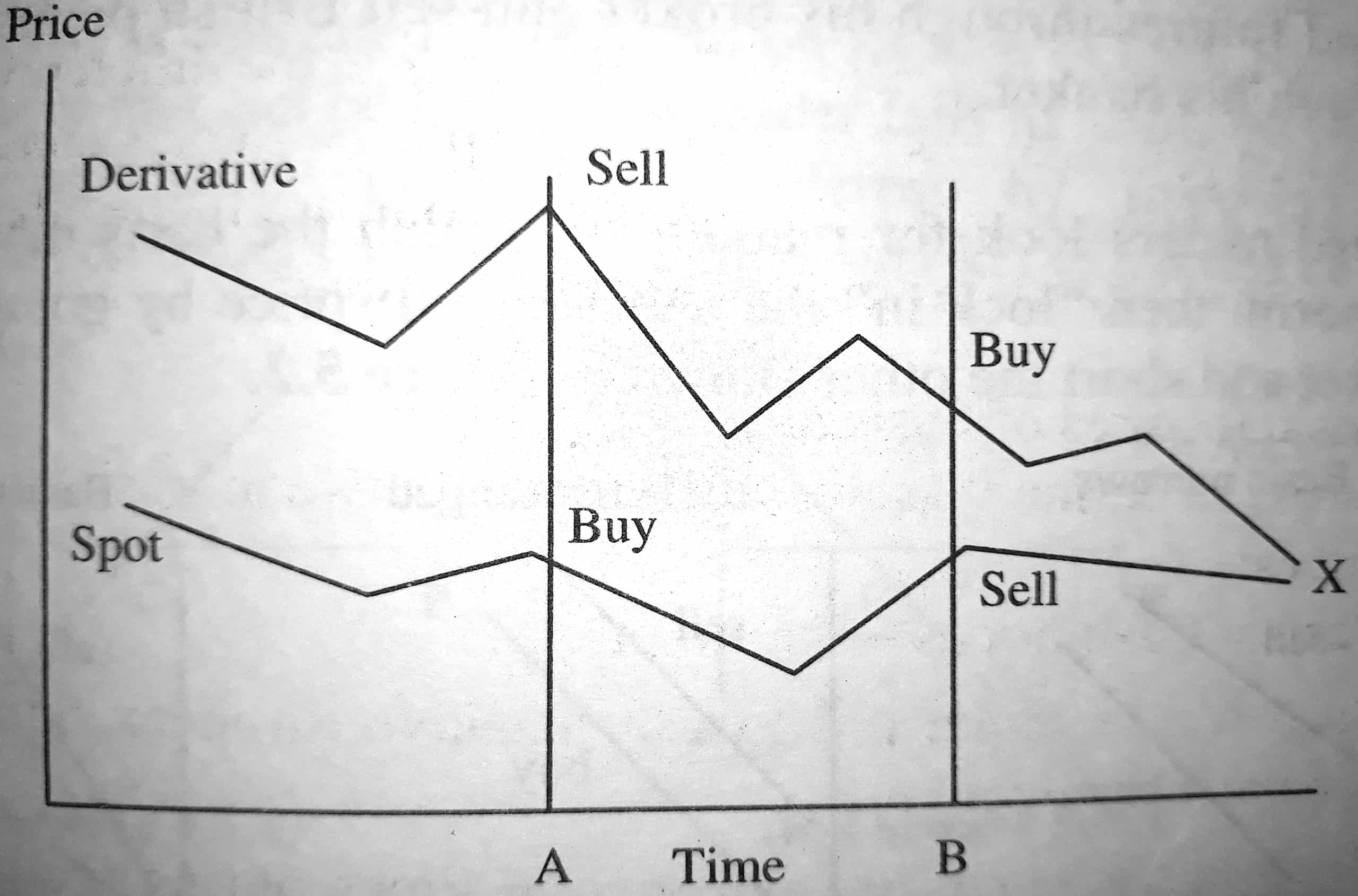

The narrowing spread between the spot and the derivative price is known as convergence which is shown in the figure. The two prices gradually converge into one price, the spot price.

The timing and amount of expected convergence are important in hedge determinations. Suppose the actual convergence at any time differs from the expected convergence, and hedge unpredictability increases.

This variability occurs because derivative traders often focus on factors other than the spot market price, such as all the news, rumors, and sentiments that go into anticipatory trading.

Convergence is rarely a smooth transition. Convergence is usually “wobbly,” with temporary under- or over-valuations of a derivative.

A spot currency and its derivative are priced against each other, showing the converging of the basis. The two prices converge when the derivative is convertible to spot (point X). The basis often deviates from its “norm” along the way, providing

opportunities for spread traders, as well as hedgers. When the basis is at a premium, as shown here, the rule is to “sell the basis when it is wide (point A); buy the basis when it is narrow (point B)”.

The opposite rule applies when the basis is at a discount: sell when narrow, buy when wide.

Both hedgers and speculative traders take an interest in these “wobbles” from the normal convergence. “Spread” traders, like hedgers, take equal and opposite positions in parallel markets; e.g., a trader may buy Treasury bill futures and sell Eurodollar futures.

(This is the popular “TED spreads.”) He may buy July com futures and sell December com, or buy options in British pound futures through his broker and sell British pound forwards through his banker.

Spread traders look for markets, in which the basis deviates from the norm, then “lock in” the apparent mid-price by going long one market and short the other shown in the figure.

Spread traders are less concerned with the market direction than they are with variations in the basis between two markets.

Profits and losses are determined by the direction of price differences, not the direction of the market. In the same manner, hedges “lockout” the overall market move.

A derivative hedge can be viewed as a spread trade and will produce gains and losses in exactly the same manner.

For this reason, the continuing price correlation between the two markets is a major consideration to the hedger.