An equity swap is a swap in which at least one party’s payments are based on the rate of return of an equity index, such as the S&P 500.

The other party’s payments can be based on a fixed rate, a non-equity variable rate, or even a different equity index.

Equity swaps provide an easy and inexpensive means of reallocating a portfolio to a different equity sector.

In an equity swap, two parties make a series of payments to each other with at least one set of payments determined by a stock or index return.

The other set of payments can be a fixed or floating rate or the return on another stock or index.

Equity swaps are used to substitute for a direct transaction in stock.

With an equity swap, payments are made based on a notional principal. This is an equity portfolio.

The payments are fixed and floating. The floating rate sum is based on the return on the relevant index for the period, while the fixed-rate sum is agreed in advance.

An equity swap is a financial derivative contract (a swap) where a set of future cash flows are agreed to be exchanged between two counterparties at set dates in the future.

The two cash flows are usually referred to as “legs” of the swap; one of these “legs” is usually pegged to a floating rate such as LIBOR.

This leg is also commonly referred to as the “floating leg.” The other leg of the swap is based on the performance of either a share of stock or a stock market index.

This leg is commonly referred to as the “equity leg.” Most equity swaps involve a floating leg or an equity leg, although some exist with two equity legs.

An equity swap involves a notional principal, a specified tenor, and predetermined payment intervals.

Equity swaps are typically traded by Delta One trading desks.

Characteristics of Equity Swaps

Following are the characteristics of equity swaps:

- One party pays the return on equity, and the other pays fixed, floating, or the return on another equity;

- Rate of return is paid, so payment can be negative; and

- Payment is not determined until the end of the period.

Types of Equity Swap

Based on the type of settlement, an equity swap can be either:

Cash-Settled Equity Swap

An agreement between two counterparties where one party receives the appreciation (and pays the depreciation) of a stock, a basket of stocks, or a stock index in exchange for the payment of a stream of interest flows and sometimes the receipt of dividend payments.

The other party has the opposite position.

Physically Settled Equity Swap

An agreement between two counterparties whereby one counterparty agrees to buy from the other counterparty the underlying shares and pays a pre-agreed amount in exchange for the payment of a stream of interest flows and sometimes the receipt of dividend payments.

An equity swap is an over-the-counter transaction between two counterparties. It is formalized through confirmation.

The confirmation is generally legally subject to the terms and clauses of the ISDA agreement signed between the two counterparties that sets-om their obligations.

Total Return Equity Swaps

A total return equity swap is a transaction in which one party – the equity swap receiver – has a position equivalent to a long position in a stock, a basket of stocks, or an equity index, while the other party – the equity swap payer – has the opposite position in the same underlying.

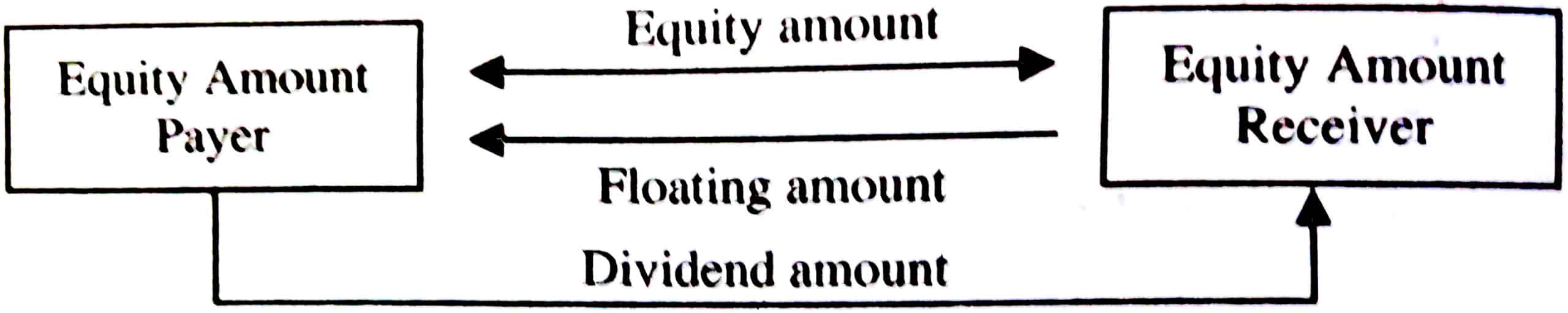

In a total return equity swap, the equity amount payer and the equity amount receiver exchange during the life of the equity swap three strings of cashflows (see figure given below):

Equity Amount

This amount reflects the price performance of a long position in the underlying stock relative to its initial price – the reference price.

The equity amount receiver is the counterparty that benefits if the stock performance is positive.

Conversely, the equity amount payer is the counterparty that benefits if the stock performance is negative.

Floating Amount

This amount reflects the cost of carrying the underlying stock. It is paid by the equity amount receiver to the equity amount payer.

The floating amount is quoted as a floating interest rate plus a fixed spread. The floating rate is typically LIBOR, EURIBOR, or a similar benchmark rate.

The fixed spread is set at swap inception. Typically, the floating amount payments are made every three months, based on the equity swap notional.

Dividend Amount

This amount reflects the benefits of carrying the underlying stock. It is paid by the equity amount payer to the equity amount receiver.

The equity swap is called a total return equity swap because the equity amount receiver receives not only the appreciation of the stock price relative to the reference price but also the dividends distributed to the underlying stock.

The equity amount receiver also pays the floating amount, which in a way resembles the interest payments of financing investment with a fictional equal to the equity amount.

Therefore, the equity swap mimics a fully financed long position in the stock.

Price Return Equity Swaps

A price return equity swap is a transaction in which one party – the equity swap receiver — has a position equivalent to a long position in only the price of a stock, a basket of stocks, or an equity index; while the other party – the equity swap payer – has the opposite position in the same underlying.

In a price return equity swap, the equity amount payer and the equity amount receiver exchange during the life of the equity swap two strings of cashflows (see figure given below):

Equity Amount

This amount reflects the price performance of a long position in the underlying stock relative to its initial price – the reference price.

The appreciation of the stock price is received by the equity amount receiver from the equity amount payer.

If, on the other hand, the stock depreciates, then the absolute value of the depreciation is paid to the equity amount payer from the equity amount receiver.

Floating Amount

This amount reflects the cost of carrying the underlying stock. It is paid by the equity amount receiver to the equity amount payer.

The equity swap is called a price return equity swap because the equity amount receiver receives only the appreciation of the stock relative to the reference price.

The equity amount receiver does not receive the dividends distributed to the underlying stock.

Therefore, the equity swap does not mimic a long position in the stock.

On a stock that pays no dividends, a total return equity swap and a price equity swap are the same instruments.

Benefits of Equity Swap

Equity swaps also provide the following benefits over plain vanilla equity investing:

1. An investor in a physical holding of shares loses possession of the shares once he sells his position.

However, using an equity swap, the investor can pass on the negative returns on equity position without losing possession of the shares and hence voting right.

For example, let us say A holds 100 shares of a Petroleum Company.

As the price of crude falls, the investor believes the stock would start giving him negative returns in the short-run.

However, his holding gives him strategic voting right on the board, which he does not want to lose.

Hence, he enters into an equity swap deal wherein he agrees to pay Party B the return on his shares against LIBOR+25bps on a notional amount.

If A is proven right, he will get money from B on account of the negative return on the stock as well as LIBOR+25bps on the notional. Hence, he mitigates the negative returns on the stock without losing voting rights.

2. It allows an investor to receive the return on security which is listed in such a market where he cannot invest due to legal issues.

For example, let us say A wants to invest in company X listed in Country C.

However, A is not allowed to invest in Country C due to capital control regulations.

He can, however, enter into a contract with B, who is a resident of Country C, and ask him to buy the shares of company X and provide him with the return on share X, and he agrees to pay him a fixed/floating rate of return.

Equity swaps, if effectively used, can make investment barriers vanish and help an investor to create leverage similar to those seen in derivative products.

Investment banks that offer this product usually take a riskless position by hedging the client’s position with the underlying asset.

For example, the client may trade a swap – say Vodafone. The bank credits the client with 1,000 Vodafone at GBP1.45.

The bank pays the return on this investment to the client but also buys the stock in the same quantity for its own trading book (1000 Vodafone at GBP1.45).

Any equity-leg return paid to or due from the client is offset against realized profit or loss on its own investment in the underlying asset.

The bank makes its money through commissions, interest spreads, and dividend rake-offs (paying the client less of the dividend than it receives itself). It may also use the hedge position stock (1000 Vodafone in this example) as part of a funding transaction such as stock lending, repo, or as collateral for a loan.