A legally binding agreement to buy or sell a commodity or financial instrument in a designated future month at a price agreed upon at the initiation of the contract by the buyer and seller.

Futures contracts are standardized according to the quality, quantity, delivery time, and location of each commodity.

A futures contract differs from an option in that an option gives one of the counterparties a right and the other an obligation to buy or sell, while a futures contract represents an obligation to both counterparties, one to deliver and the other to accept delivery.

A future is part of a class of securities called derivatives, so named because such securities derive their value from the worth of an underlying investment.

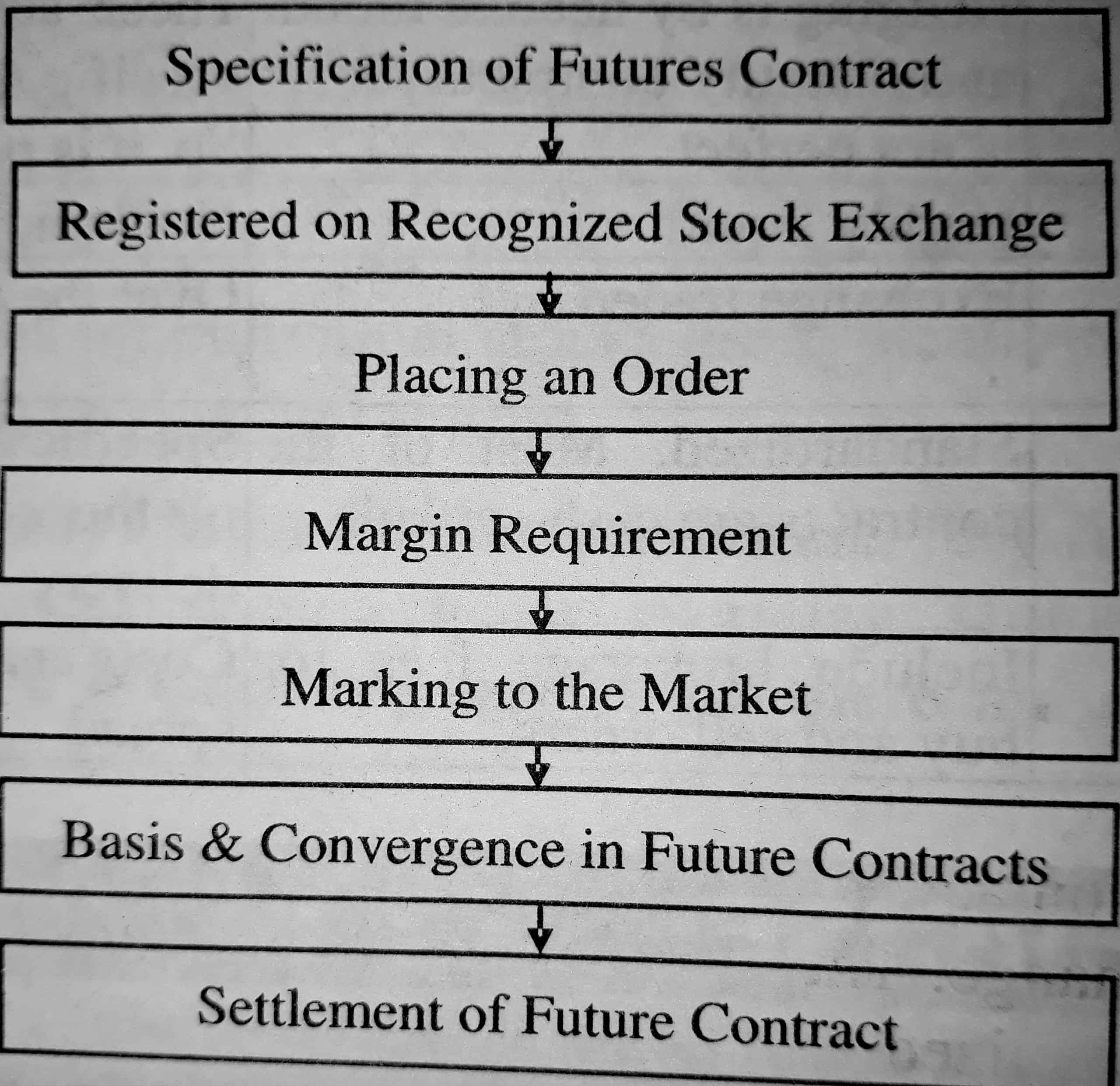

The mechanics of the future market means how the futures market works. It involves the following aspects: