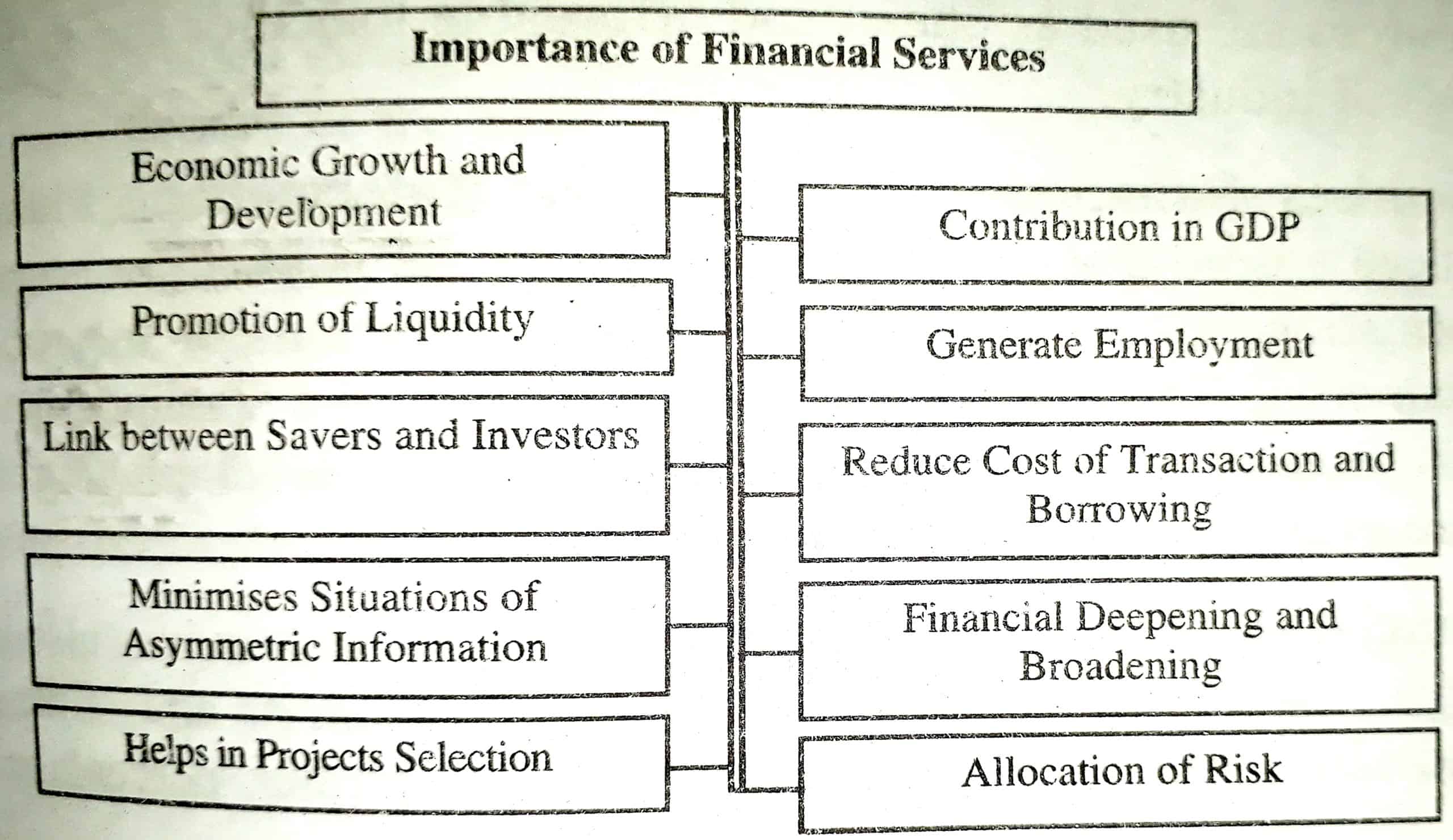

Financial services are important due to the following reasons:

1. Economic Growth and Development: Financial services play a major role in the growth of the economy.

Banking, investment, savings, insurance, stock markets, debt, and equity shares, etc., help private entities as well as individuals to save funds, compete in the market and protect against risks and ambiguity.

It also helps in giving necessary credit to businesses both in the form of loans and working capital finance. Financial services assist the poor and the marginalized through specific financial programs.

These help the lower-income groups to come out of poverty and create wealth.

2. Contribution in GDP: Financial services form a major part of the GDP. Globally the financial sector is the largest in terms of earnings.

It has a wide variety of banks, credit card organizations, merchant bankers, stock exchanges, insurance companies, etc. These all contribute to the GDP of the nation.

3. Promotion of Liquidity: The financial services are providers of liquidity. The liquidity ensures that there is no shortage of finance both for long-term uses as well as short-term operations in the form of working capital finance.

Liquidity refers to cash and other assets that can be converted into cash quickly.

For example, the land is a less liquid asset than marketable securities because it takes time to convert the land into cash.

4. Generate Employment: The financial services are growing at a fast clip and are large providers of jobs to society. They also help to increase the scope of the financial markets.

They are also instrumental in attracting the much needed FDI for the growth of the economy. This is particularly necessary for a developing country like India.

5. Link between Savers and Investors: The financial services act as a channel between the savers and the spenders. It is a channel to collect the idle resources that are lying with the public and bring them into effective use.

It also ensures the continuous up-gradation of the technology levels and the capability of the economy and thus ensures sustainable growth.

6. Reduce Cost of Transaction and Borrowing: The financial services industry creates an infrastructure that lowers the cost of transaction and borrowing costs for borrowers.

It also increases the return that investors make by lending to borrowers. It leads to a saving mindset in the economy and thus helps in increasing growth prospects through the efficient use of resources.

These resources are used as cheap and affordable loans for the growing needs of the industry.

7. Minimises Situations of Asymmetric Information: FinanciM services ensure that all the participants in the market get access to information.

In other words, it removes situations of information asymmetry. This has a direct impact on the inclination and motivation of participants as they perceive a level playing field where everyone has the same information.

8. Financial Deepening and Broadening: Financial services also help in the twin objectives of financial deepening and financial broadening.

Financial deepening means a greater percentage of assets as a percentage of GDP, whereas financial broadening refers to an increase in the participants and also the options that are available in the form of financial instruments.

9. Helps in Projects Selection: Financial services aid in the selection of projects and not just a means of funding their execution.

It also creates a payment mechanism that ensures the smooth transfer of goods and services, resources across regions, and time zones.

10. Allocation of Risk: One of the biggest tasks performed by financial services is the optimization of risk. They pool the resources of the investors and allocate in such a manner that overall risk is mitigated.

Financial services also bring down the risk in the market by ensuring that all the participants have access to the required information, and there is no disparity.