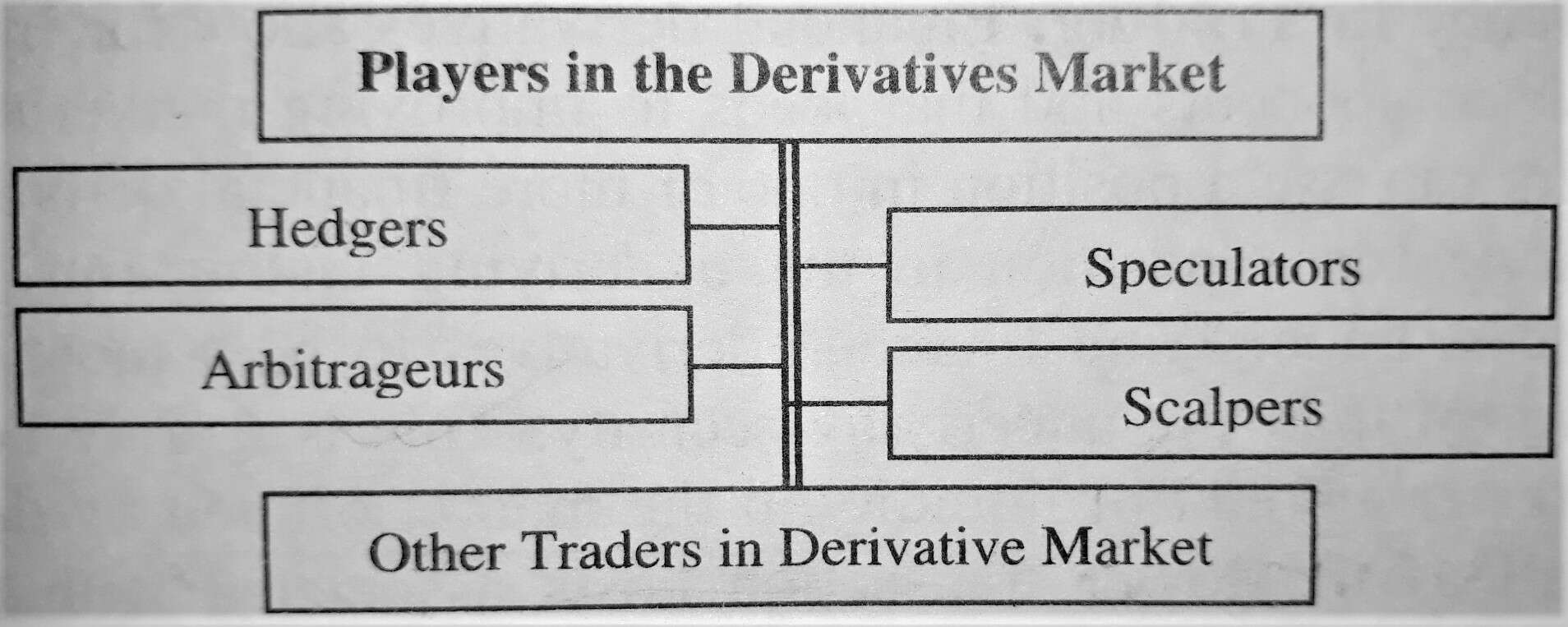

Derivatives are used by businesses, individuals, and governments to accomplish a wide variety of objectives. These may be broadly classified into the following categories:

Hedgers

Hedgers are those traders who wish to eliminate the price risk associated with the underlying security being traded. The objective of these kinds of traders is to safeguard their existing positions by reducing the risk. They are not in the derivatives market to make profits.

Apart from equity markets, hedging is common in the foreign exchange markets where fluctuations in the exchange rate have to be taken care of in the foreign currency transactions or in the commodities market where spiraling oil prices have to be controlled using security derivative instruments.

For example, an investor holding shares of ITC and fearing that the share price will decrease in the future takes an opposite position (sell futures contracts) to minimize the extent of loss if the share will fall.

Speculators

While hedgers might be adept at managing the risks of exporting and producing petroleum products worldwide, there are parties who are adept at managing and even making money out of such exogenous risks.

Using their own capital and that of clients, some individuals and organizations will accept such risks in expecting a return. But unlike investing in business along with its risks, speculators have no clear interest in the underlying activity itself. For the possibility of a reward, they are willing to accept certain risks.

They are traders with a view and objective of making profits. These are people who take positions (either long or short positions) and assume risks to profit from fluctuations in prices. They are willing to take risks, and they bet upon whether the markets would go up or come down.

Speculators may be either day traders or position traders. The former speculate on the price movements during one trading day, while the latter attempt to gain keep their position for a longer time period to gain from price fluctuations.

The previous example (ITC) is also possible to short futures without actually owning shares in the spot market. The speculator does so because he expects ITC to fall, and by entering into short futures, he gains if the price falls.

The speculator is not required to pay the entire value, i.e., (Number of futures contracts x shares under each contract x delivery price). Only margin money, which accounts for 5-10% of the total transacted value, is paid upfront by the speculator. Thus, futures are highly levered instruments.

For example, if the margin money required is 10%, the speculator can take ten contracts by paying the one contract price.

Arbitrageurs

The third player is known as the arbitrageur. These market participants look for mispricing and market mistakes, and by taking advantage of them, they disappear and never become too large.

If you have even purchased a greengrocer product only to discover the same product somewhat cheaper at the next grocer, you have an arbitrage situation. Arbitrage is the process of the simultaneous purchase of securities or derivatives in one market at a lower price and the sale thereof in another market at a relatively higher price.

For example, on maturity, if the pepper futures contracts are Rs.650 per kg, and the spot price is Rs.642, then the arbitragers will buy pepper in spot and short sell futures, thereby gaining riskless profit of Rs.650-Rs.642, i.e., Rs.8 per kg. Here, the two markets are spot and futures markets. Thus, riskless profit-making is the prime goal of arbitrageurs.

Scalpers

A scalper is a person trading in the equities or options and futures market who holds a position for a very short period of time in an attempt to profit from the bid-ask spread. Scalpers buy large quantities of in-demand items at regular prices, hoping that the items will sell out, and then resell the items at a higher price.

They try to exploit the constant fluctuations in commodities of securities prices during trading hours. They do not expect to make large profits on each trade, but they generate a large number of transactions throughout the trading point.

The rapid trading that occurs in legitimate scalping usually results in small gains, but several small gains can add up to large returns at the end of the day.

Other Participants in the Derivative Market

All resident Indians, NRIs, FIIs, and Mutual Funds can trade in derivatives markets. In order to ensure that the derivative market functions efficiently, it is important to maximize the number of participants in the market to encompass individuals, banks, financial institutions, NBFCs, mutual funds, insurance companies, and corporate.

1) Individuals: Individuals are the most important players in the market who buy or sell contracts. They are Clients of trading members. They use derivatives to enhance their yield, or perhaps to take out speculative positions. A derivative provides them an alternative to investing directly in assets without buying and holding the asset itself.

2) Banks: Banks would typically be both buyers and sellers of credit risk in the market. There may be cases where a bank believes that it is overexposed to a particular credit or industry. In such a case, the bank will wish to buy protection.

Conversely, there may be sectors or highly rated companies or fast-growing companies to which a bank has little or no exposure. Entering the consortium may be a time-consuming exercise. In such a case, the bank will wish to sell protection.

Buying and selling of participation in the priority sector is one example where derivatives have been practiced for several years in a different form.

3) Financial Institutions and NBFCs: Financial Institutions and NBFCs may also find themselves in a similar position to the banks and are thus likely to be both buyers and sellers in the market.

4) Mutual Funds and Insurance Companies: Mutual funds and insurance companies that have an investment where they anticipate spread widening would typically be buyers of protection.

Similarly, mutual funds and insurance companies that are looking for yield enhancement and believe that the spreads of a given company are expected to narrow would typically be sellers of protection. Mutual funds and insurance companies may also sell protection as a means to diversify their portfolio and broaden their asset base.

5) Corporates: Companies may participate in the derivatives market to either buy or sell protection. One instance where a company would wish to buy protection is when it is overexposed to one or more buyers. Conversely, parent companies sometimes provide guarantees to banks on behalf of subsidiaries, and these could easily be structured as derivatives.

6) Trading Member: A member of the exchange and one who trades on his own behalf and on behalf of his clients. On BSE, they are called Limited Trading Members.

7) Clearing Member: One who undertakes to settle his own trades as well as the trades of the other non-clearing members, known as Trading Members, who have agreed to settle the trades through them.