SEBI set up a 24-member committee under the Chairmanship of Dr L.C. Gupta to develop the appropriate regulatory framework for derivatives trading in India.

On May 11, 1998, SEBI accepted the recommendations of the committee and approved the phased introduction of derivatives trading in India beginning with stock index futures.

The provisions in the Securities Contract (Regulation) Act, 1956 – SC(R)A and the regulatory framework developed thereunder govern trading in securities.

The amendment of the SC(R)A to include derivatives within the ambit of ‘securities’ in the SC(R)A made trading in derivatives possible within the framework of that Act.

Regulatory Framework of Derivative Market

The futures and options markets, like the securities markets, are essential to the economic growth and prosperity of an economy.

These markets play a significant role in the efficient allocation of the resources of a country. No doubt, therefore, that futures and options exchanges (and over-the-counter derivatives markets) are integral parts of virtually all economics that have reached an advanced stage of development.

Due to the economic significance of the derivatives markets, their integrity is a matter of public interest. It is imperative, therefore, that such markets be properly regulated.

Market integrity and efficiency, financial safety, and customer protection are vital to the success of any financial market, the regulators should strive to make securities and derivatives markets fair, transparent, and orderly to instill investors’ confidence in them.

For this, it is necessary to regulate trading, devise controls to prohibit manipulative or fraudulent conduct, establish high standards for market intermediaries, and vigorously enforce rules and regulations.

A lack or inadequacy of measures against manipulation, fraud, and improper activities is likely to lead to market abuse resulting in inefficient markets, higher transactional and systemic costs, losses to investors, and loss of investor confidence in the market.

It is imperative, therefore, that such markets be properly regulated so that they can be viewed by investors, present and potential, to be fair and transparent.

An effective regulatory framework calls for ensuring:

- A mechanism for imposing responsibility and accountability on market operators and intermediaries like exchanges, brokers, clearing, and settlement agents;

- A mechanism for monitoring compliance with the laws and rules governing the transactions; and

- An effective system for enforcing laws and regulations of the exchanges and other market intermediaries governing operations in these markets.

To meet the desired goals of regulation, it is necessary to ensure the following:

1. The derivatives products to be traded should be carefully designed to meet the requirements of customers.

For example, while designing a contract on the stock index, consideration should be given to the method of calculation of the index, the number of stocks to be included in the index, the variation in stock prices, replacement of constituent stocks in the index, and the ‘multiplier to determine the value of a futures contract.

2. The rules regarding fair and efficient execution of orders should be stated clearly and enforced consistently.

3. Constant scrutiny of trading should be done so as to identify manipulative behavior.

4. The exchanges should develop enough capacity in terms of manpower and technology to take on large trade volumes.

5. The exchanges should have enough powers to appropriately punish erring participants.

6. Appropriate capital adequacy norms should be set and implemented.

7. An adequate margining system should be in place because it is the margins that underlie the safety provided by the clearinghouse.

Margins should neither be too high (making entering into derivatives trading too costly) nor should they be too low (making the risk of default to be high). The marking-to-the-market of margins should be done to ensure financial integrity.

8. Although marking-to-market margins provide protection of the financial integrity of the system against price volatility, additional measures may sometimes be needed in the face of abnormal volatility or market disruption characterized by rapid market declines that threaten to create panic or disorderly market conditions.

To meet such contingencies, adequate measures need to be taken. They include circuit breakers – trading halt in the cash market and a corresponding halt in the derivatives market – and setting of price limits.

9. The rules establishing the priorities by which orders may be executed should be clearly laid and properly enforced in order to ensure fairness and to prevent fraud.

10. Proper records must be kept for a sufficiently long period of time to enable checking, at any time, on whether the proper execution rules have been followed.

11. Appropriate forums should be provided for customers to settle disputes, if any, in trading.

Framework of Derivatives Markets

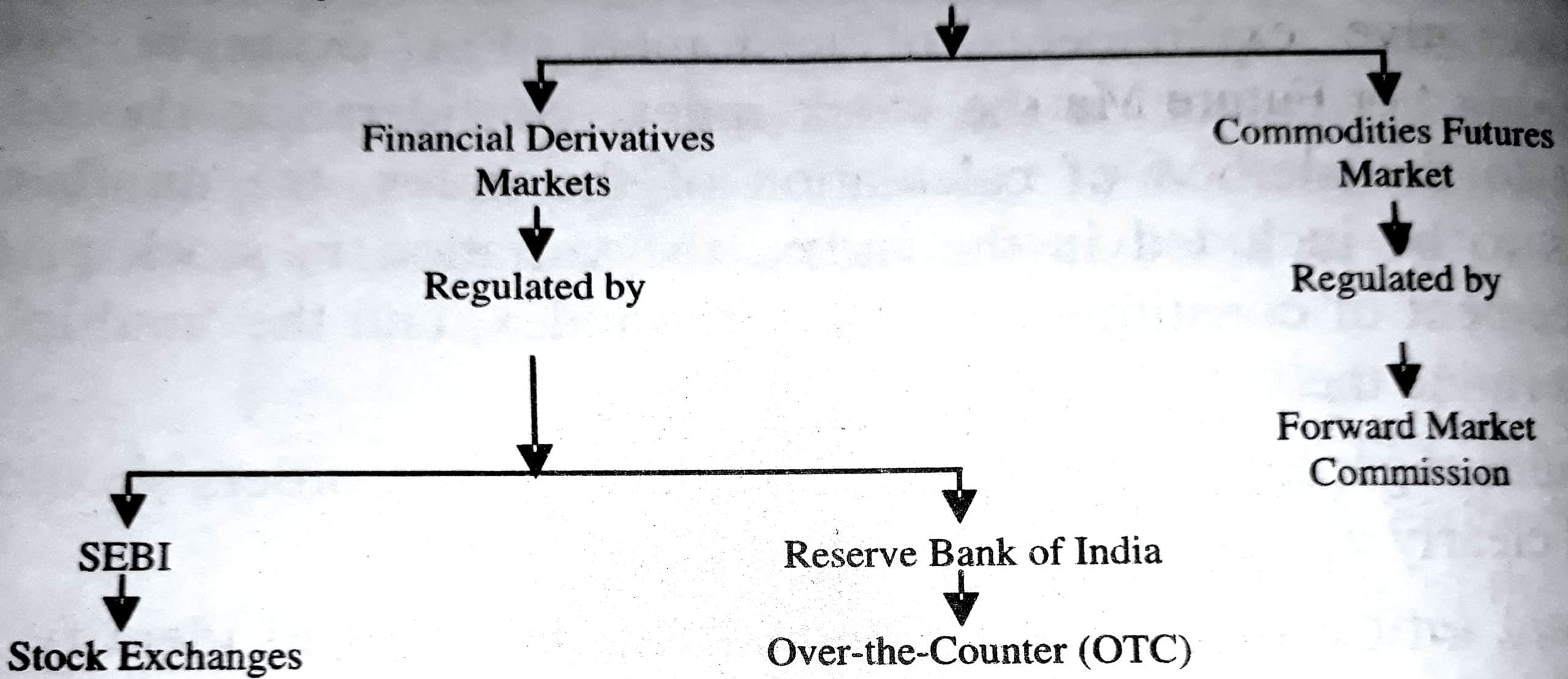

Derivatives markets in India can be broadly categorized into two markets namely.

Financial Derivatives Markets

Financial derivatives markets in India are regulated and controlled by the Securities and Exchange Board of India (SEBI).

The SEBI is authorized under the SEBI Act to frame rules and regulations for financial futures trading on the stock exchanges with the objective to protect the interest of the investors in the market.

Further, carry forward trading (Badla trading) is also regulated by the SEBI which is traded on the stock exchanges.

Financial derivatives markets deal with the financial futures instruments like stock futures, index futures, stock options, index options, interest rate futures, currency forwards and futures, financial swaps, etc.

Major stock exchanges in India, under the regulation of the SEBI, trade in two kinds of futures products, namely equity and carryforwards.

Equity futures include stock futures, index futures, stock options, and index options. Currently, these are traded on National Stock Exchange and Bombay Stock Exchange.

Examples of such companies on which options and futures are available- are ACC, SBI, CIPLA, HPCL, TELCO, GRASIM, Dr. Reddy, Lab, HLL, HDFC, Hero Honda, etc.

Some of the other financial derivatives like currency options and futures and interest rate futures are controlled by the Reserve Bank of India (RBI).

These are dealt with in Over-the-Counter (OTC) markets. Financial futures on interest rate include both the short-term interest rate and long-term interest rate forwards.

Currencies include options and forwards. Since the RBI is the apex body to regulate currencies and interest rates in India, hence, financial derivatives relating to foreign currencies and interest rates generally come under the RBI regulation.

The Derivative Market can be classified as Exchange Traded Derivatives Market and Over the Counter Derivative Market.

Exchange Traded Derivatives

Exchange Traded Derivatives are those derivatives that are traded through specialized derivative exchanges.

In the Exchange Traded Derivatives Market and Future Market, the exchange acts as the main party and by the trading of derivatives actually, the risk is traded between two parties.

One party who purchases a futures contract is said to go “long” and the person who sells the futures contract is said to go “short”.

Over the Counter Derivatives

Over Counter Derivatives are those which are privately traded between two parties and involve no exchange or intermediary.

Swaps, Options, and Forward Contracts are traded in Over the Counter Derivatives Market or OTC market.

Commodities Futures Market

Commodity futures markets are regulated in India by the forwarding Market Commission (FMC).

The commission is entrusted with regulating commodities futures trading in India. Products like Hessian, potatoes, pepper, cotton, etc., are traded on Coimbatore Commodity Exchange and Calcutta Commodity Exchange.

Recently the Central Government has allowed futures trading on 54 new commodities of different categories to be eligible for trading on exchanges.

SEBI Guidelines for Derivative Trading

In India, the following are the major SEBI regulations for the trading of derivatives:

1. Any exchange fulfilling the eligibility criteria as prescribed in the L.C. Gupta committee report may apply to SEBI for a grant of recognition under Section 4 of the SC(R)A, 1956 to start trading derivatives.

The derivatives exchange/segment should have a separate governing council and representation of trading/clearing members shall be limited to a maximum of 40% of the total members of the governing council.

The exchange shall regulate the sales practices of its members and will obtain prior approval from SEBI before the start of trading in any derivative contract.

2. The exchange shall have a minimum of 50 members.

3. The members of an existing segment of the exchange will not automatically become members of the derivative segment.

The members of the derivative segment need to fulfill the eligibility conditions as laid down by the L.C. Gupta committee.

4. The clearing and settlement of derivatives trades shall be through a SEBI-approved clearing corporation/house.

5. Derivative brokers/dealers and clearing members are required to seek registration from SEBI. This is in addition to their registration as brokers of existing stock exchanges.

The minimum net worth for clearing members of the derivatives clearing corporation/house shall be ₹300 lakh. The network of the member shall be computed as follows:

Capital + Free reserves – non-allowable assets

Non-allowable assets are as follows:

- Fixed assets;

- Pledged securities;

- Member’s card;

- Non-allowable securities (unlisted securities);

- Bad deliveries;

- Doubtful debts and advances;

- Prepaid expenses;

- Intangible assets;

- 30% marketable securities.

6. The minimum contract value shall not be less than ₹2 lakh. Exchanges should also submit details of the futures contract they propose to introduce.

7. The initial margin requirement, exposure limits linked to capital adequacy, and margin demands related to the risk of loss on the position shall be prescribed by SEBI/Exchange from time to time.

8. The L.C. Gupta committee report requires strict enforcement of the “Know your customer” rule and requires that every client shall be registered with the derivatives broker.

The members of the derivatives segment are also required to make their clients aware of the risks involved in derivatives trading by issuing to the client the Risk Disclosure Document and obtaining a copy of the same duly signed by the client.

9. Derivative trading to take place through an online screen-based Trading System.

10. The Derivatives Exchange/Segment shall have online surveillance capability to monitor positions, prices, and volumes on a real-time basis so as to deter market manipulation.

11. The Derivatives Exchange/Segment should have arrangements for the dissemination of information about trades, quantities, and quotes on a real-time basis through at least two information vending networks, which are easily accessible to investors across the country.

12. The Derivatives Exchange/Segment should have arbitration and investor grievances redressal mechanism operative from all four areas/regions of the country.

13. The Derivatives Exchange/Segment should have a satisfactory system of monitoring investor complaints and preventing irregularities in trading.

14. The Derivative Segment of the Exchange would have a separate Investor Protection Fund.

15. The Clearing Corporation/House shall perform full novation, i.e., the Clearing Corporation/House shall interpose itself between both legs of every trade, becoming the legal counterparty to both, or alternatively should provide an unconditional guarantee for settlement of all trades.

16. The Clearing Corporation/House shall have the capacity to monitor the overall position of Members across both the derivatives market and the underlying securities market for those Members who are participating in both.

17. The level of initial margin on Index Futures Contracts shall be related to the risk of loss on the position. The concept of value-at-risk shall be used in calculating the required level of initial margins.

The initial margins should be large enough to cover the one-day loss that can be encountered on the position on 99% of the days.

18. The Clearing Corporation/House shall establish facilities for Electronic Funds Transfer (EFT) for the swift movement of margin payments.

19. In the event of a Member defaulting in meeting its liabilities, the Clearing Corporation/House shall transfer client positions and assets to another solvent Member or close out all open positions.

20. The Clearing Corporation/House should have the capabilities to segregate initial margins deposited by Clearing Members for trades on their own account and on the account of their client.

The Clearing Corporation/House shall hold the clients’ margin money in trust for the client’s purposes only and should not allow its diversion for any other purpose.

21. The Clearing Corporation/House shall have a separate Trade Guarantee Fund for the trades executed on Derivative Exchange/Segment.

22. Presently, SEBI has permitted Derivative Trading on the Derivative Segment of BSE and the F&O Segment of NSE.

RBI Guidelines for Derivative Trading

Reserve Bank of India set up a committee under the Chairmanship of R.V. Gupta to review ‘Hedging’ through International Commodity Exchanges and other related issues. The committee’s main recommendations were as follows:

1. All Indian companies with genuine commodity price risk exposures be allowed to hedge through offshore commodity futures and options markets.

2. The Central Government should grant permission for such hedging transactions and the RBI should grant the necessary exchange control permission.

3. Only hedging contracts for genuine price exposure through international markets should be allowed and not speculative or profit-seeking objectives.

4. OTC instruments like vanilla swaps would only be permitted where they have only efficient means of hedging.

5. Use of options would not be allowed.

6. The committee recommended a phased manner approach.

7. In Phase-I, the hedging should ordinarily be through exchange-traded commodity futures.

8. Phase-I, would be a period of acclimatization. At this stage prior approval would be required:

- To ensure the existence of genuine underlying risk,

- The appropriateness of the hedging instrument, and

- Adequateness of risk management procedures.

9. In Phase II, no prior approval, as recommended in Phase-I should be needed. Only periodic scrutiny of actual transactions and auditor’s certification adequacy of control is sufficient.

10. The committee further recommends that hedging should be allowed through foreign derivatives markets.

However, the futures markets experts observed that due to the lack of experience in the Indian corporate sector regarding the functioning of international commodity derivatives and inadequate experience amongst auditors, a longer ‘acclimatization’ period of at least three years is desirable instead of one year as recommended by the committee.

Forward Market Commission (FMC)

Established in 1953 under the provisions of the Forward Contracts (Regulation) Act, 1952, it consists of two to four members, all appointed by the Indian Government.

Currently, the Commission allows commodity trading in 22 exchanges in India, of which three are national.

Uniquely the FMC falls under the Ministry of Consumer Affairs, Food, and Public Distribution and not the Finance Ministry as in most countries.

This is because futures, traded in India, are traditionally on food commodities. However, this has been changing and there have been calls for change in the industry and in regulation.

One proposal is the merging of the commodities derivatives and securities regulation by including the Forward Market Commission within the Securities and Exchange Board of India (SEBI), the primary securities regulator in India.

However, as of 2003, there is no clear consensus on this move.

This was set up under the Forward Contracts (Regulation) Act, 1952. It is responsible for regulating and promoting futures/forward trade in commodities.

The forward markets commission’s Head Quarters is located in Mumbai and is overseen by the Ministry of Consumer Affairs, Food and Public Distribution, Government of India, and regional office at Kolkata.

Responsibilities and Functions

The functions of the forward markets commission are as follows:

- To advise the Central Government in respect of the recognition or the withdrawal of recognition from any association or in respect of any other matter arising out of the administration of the Forward Contracts (Regulation) Act 1952.

- To keep forward markets under observation and to take such action in relation to them, as it may consider necessary, in the exercise of the powers assigned to it by or under the Act.

- To collect and whenever the Commission thinks it necessary, to publish information regarding the trading conditions in respect of goods to which any of the provisions of the Act is made applicable, including information regarding supply, demand, and prices, and to submit to the Central Government, periodical reports on the working of forwarding markets relating to such goods.

- To make recommendations generally with a view to improving the organization and working of forwarding markets.

- To undertake the inspection of the accounts and other documents of any recognized association or registered association or any member of such association, whenever it considers it necessary.