This structure entitles investors to buy foreign currency at a specified protected ’worst-case’ rate of exchange or at a more favourable rate, as far as a predetermined ‘best possible’ limit rate. If the limit rate is hit or exceeded at any time during the life of the trade, investors are obliged to deal at the protected worst-case rate. There is no premium payable for a forward extra (FE).

To take out an FE contract, you need to advise us of the amount, the currencies involved, the expiry date, and the worst rate at which you would like to buy foreign currency. We will then tell you the limit rate.

This product is best explained with an example.

How an FE works

For example, you import materials from the US and have to pay a supplier USD 500,000 in six months’ time.

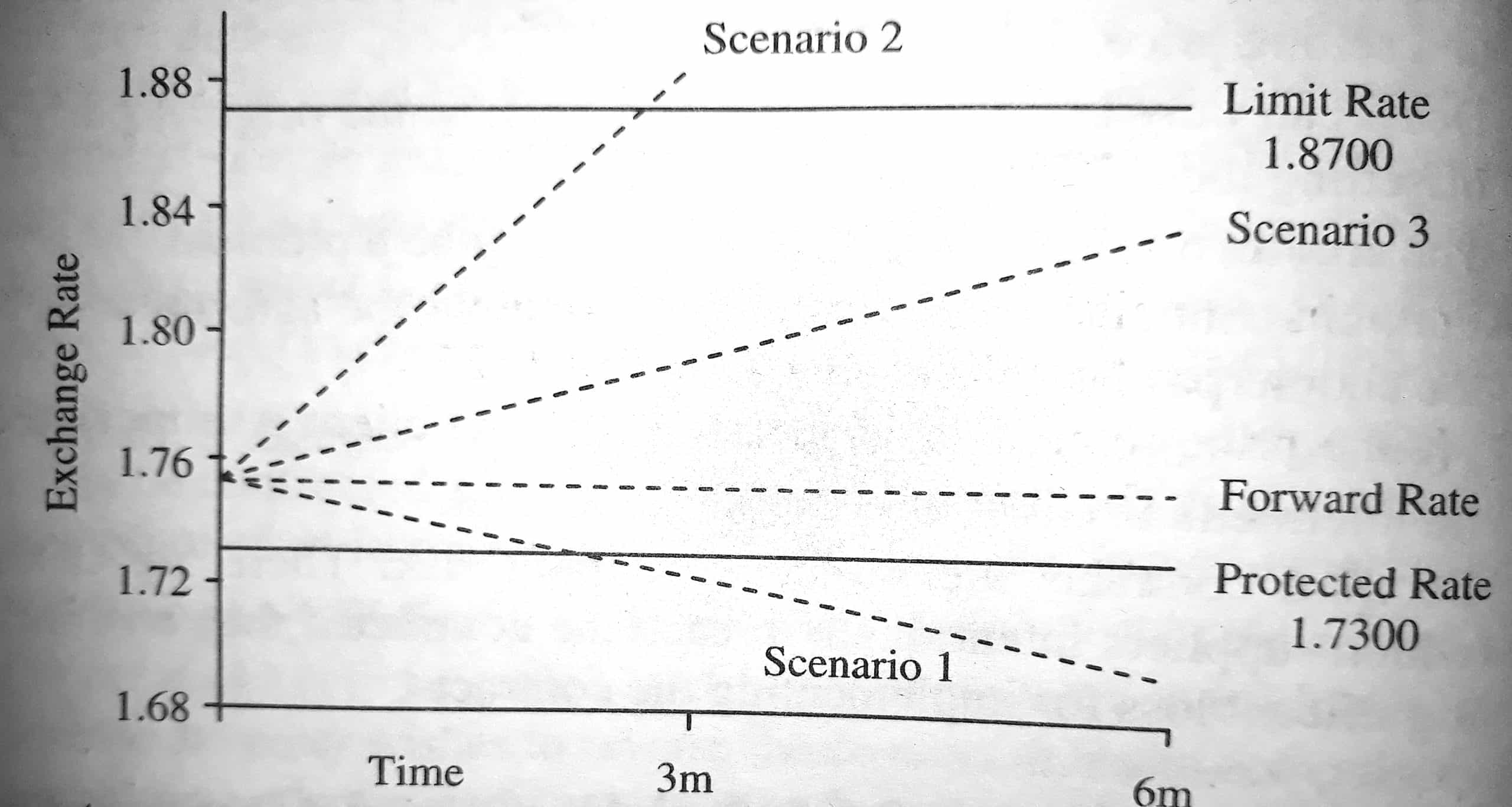

The forward rate for six months is 1.7520. You would like to benefit from favourable exchange rate moves but are reluctant to pay a premium for this. You inform us that you are prepared to accept a worst-case rate of 1.7300. We then calculate the limit rate (which is dependent on market variables at the time) to be 1.8700.

Possible Scenarios

Scenario 1: GBP/USD weakens, and at the maturity of the contract the exchange rate is 1.6900. You are entitled to buy dollars at 1.7300.

Scenario 2: GBP/USD strengthens, and trades through 1.8700 at any time ‘ during the life of the contract. You are obliged to buy dollars at 1.7300.

Scenario 3: GBP/USD strengthens, and at maturity, the exchange rate is 1.8400 (1.8700 has not traded during the life of the contract). You can buy dollars in the spot market at 1.8400.

Advantages

- Provides protection on 100 per cent of your exposure.

- Allows you to benefit from favourable currency moves up to a pre-agreed limit.

- No premium is payable.

Disadvantages

- If the limit rate is hit or exceeded at any time during the life of the contract, you deal at the worst-case (protected) rate.

- The protected rate will always be less favourable than the forward rate.