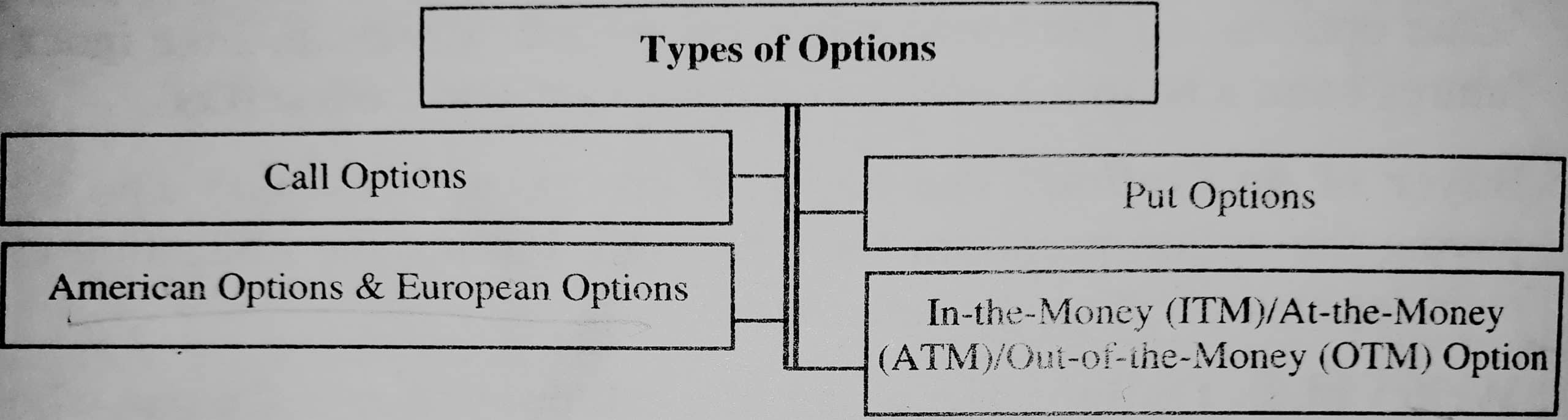

Basically, there are four types of options:

Call Options

In a call option, the option buyer has the right (but not the obligation) to buy the commodity at the predetermined price (in a sense, ‘call’ for the item from the market, hence the term).

A call option is purchased in hopes that the underlying stock price will rise well above the strike price, at which point you may choose to exercise the option.

Exercising a call option is the financial equivalent of simultaneously purchasing the shares at the strike price and immediately selling them at the now higher market price.

Rights of Buyer of Call Options

The buyer of an equity call option has purchased the right, but not the obligation, to buy 100 shares of the underlying stock at the stated exercise price at any time before the option expires.

Once the option is purchased, the buyer is then “long” the call contract, and to purchase 100 underlying shares, he notifies his brokerage firm of his intent to exercise the call contract.

For example, the buyer of one XYZ June 60 call option has the right to purchase 100 shares of XYZ stock at Rs. 60 per share up until the June expiration.

Potential Profit: Unlimited as the underlying stock price increases.

Potential Loss: Limited to premium paid-for call option.

Rights of Seller of Call Options

An investor who sells an option contract that he does not already own is known as the option “writer” and is then “short” the contract.

The writer of an equity call option, commonly referred to as the “seller,” has an obligation to sell 100 shares of the underlying stock at the stated exercise price if assigned an exercise notice at any time before the option expires.

For example, the writer of an XYZ June 75 call option has an obligation to sell 100 shares of XYZ stock at Rs. 75 per share if assigned at any time until June expiration.

Potential Profit: Limited to the premium received from the call’s initial sale.

Potential Loss: Unlimited as the underlying stock price increases.

For example, A enters into a contract with B whereby A has the right to purchase 100 ounces of gold from B for $400 per ounce at any time prior to August 1.

For granting this option, A pays B an option premium of $5 per ounce. This is a call option.

Example 1: Jerry House paid a premium of Rs. 4 per share for one 6-month call contract (total of Rs. 400 for 100 shares) of the Mahony Corporation.

At the time of the purchase, Mahony stock was selling for Rs. 56 per share, and the exercise price of the call option was Rs. 55.

1. Determine Jerry’s profit or loss if the price of Mahony’s stock is Rs. 54 when the option is exercised?

2. What is Jerry’s profit or loss if the price of Mahony’s stock is Rs. 62 when the option is exercised? Ignore taxes and transaction costs.

Solution:

i. Cost of call = (Rs. 4 premium) x 100 = Rs. 400

Ending value = (-Rs. 400 cost) + (0 gain) = Rs. 400 loss

The option was worthless because the stock’s price is less than the exercise price at maturity.

ii. Cost of call = Rs. 400

Ending value = -Rs. 400 + (Rs. 62 – Rs. 55) x 100 = -Rs. 400 + Rs. 700 = Rs. 300 gain

Put Options

In put options, the option buyer has the right to sell the commodity (in a sense, ‘put’ the commodity in the market).

A put option is purchased in hopes that the underlying stock price will drop well below the strike price, at which point you may choose to exercise the option.

For example, A enters into a contract with B whereby he has the option to sell 100 ounces of gold to B at a price of $400 anytime before August 1.

For granting him this option, A pays B $6 per ounce as a premium. This is a put option.

Rights of Buyer of Put Options

A put option gives the holder the right to sell an asset at a certain price within a specific period of time. Puts are very similar to having a short position on a stock.

Buyers of puts hope that the price of the stock will fall before the option expires.

The buyer of an equity put option has purchased the right, but not the obligation, to sell 100 shares of the underlying stock at the stated exercise price at any time before the option expires.

Once the option is purchased, the buyer is then “long” the put contract, and to sell 100 underlying shares, he notifies his brokerage firm of his intent to exercise the put contract.

For example, the buyer of one XYZ June 70 put option has the right to sell 100 shares of “XYZ stock at Rs. 70 per share up until the June expiration.

Potential Profit: Substantial and increases as the underlying stock price decreases to zero.

Potential Loss: Limited to premium paid for the put.

Rights of Writer of Put Options

An investor who sells an option contract that he does not already own is known as the option “writer” and is then “short” the contract.

The writer of an equity put option, commonly referred to as the “seller, has the obligation to purchase 100 shares of the underlying stock at the stated exercise price if assigned an exercise notice at any time before the option expires.

For example, the writer of an XYZ June 80 put option has the obligation to purchase 100 shares of XYZ stock at Rs. 80 per share if assigned at any time until June expiration.

Potential Profit: Limited to the premium received from the put’s initial sale.

Potential Loss: Substantial and increases as the underlying stock price decreases to zero.

Example 2: Jim Poston is bearish on the stock of Justus Corporation. Therefore, Jim purchases four put option contracts on Justus stock for a premium of Rs. 3.

The option’s striking price is Rs. 40, and it has a maturity of 3 months. Justus has a current market price of Rs. 39.

If Jim is correct and Justus’s price falls to Rs. 30, how much profit will he earn over the 3-month period? Ignore transaction costs and taxes.

Solution: Cost of Put = (Rs. 3 per share) x (100 shares per contract) x (4 contracts) = Rs. 1,200

Put’s Intrinsic Value = Striking Price m Ending Price = Rs. (40 – 30) = Rs. 10 per share

Total Value at Maturity = (Rs. 10 per share) x (100 shares) x (4 contracts) = Rs. 4,000

Net Gain = Rs. 4,000 – Rs. 1,200 = Rs. 2,800

Difference between Put Option and Call Option

|

Basis |

Put Options |

Call Options |

|

1. Meaning |

A Put option represents the right (but not the requirement) to sell a set number of shares of stock (which you do not yet own) at a pre-determined ‘strike price’ before the option reaches its expiration date. |

A Call option represents the right (but not the requirement) to purchase a set number of shares of stock at a pre-determined ‘strike price’ before the option reaches its expiration date. |

|

2. Purpose |

A put option is purchased in hopes that the underlying stock price will drop well below the strike price, at which point you may choose to exercise the option. |

A call option is purchased in hopes that the underlying stock price will rise well above the strike price, at which point you may choose to exercise the option. |

|

3. Example |

A enters into a contract with B whereby he has the option to sell 100 ounces of gold to B at a price of $400 anytime before August 1. For granting him this option, A pays B $6 per ounce as a premium. This is a put option. |

A enters into a contract with B whereby A has the right to purchase 100 ounces of gold from B for $400 per ounce at any time prior to August 1. For granting this option, A pays B an option premium of $5 per ounce. This is a call option. |

American Options & European Options

American options are options that can be exercised at any time up to the expiration date. Most exchange-traded options are American.

Most of the options that trade on organized exchanges are American options.

For example, the Chicago Board Options Exchange (CBOE) trades American options, primarily on stocks and stock indexes like the S&P 100 and the S&P 500.

European options trading from the mid-1980s through 1992 on the American Stock Exchange and are often traded in the over-the-counter market as well.

The American Stock Exchange reintroduced them in the late 1990s.

For example, on March 1, the price of copper is $1800 per tonnes. A apprehends a rise in price and buys an American option on June Copper (maturity date June 15) at a strike price of $1800.

The prices subsequently are as follows:

May 15: $2,100

June 15: $1,700

As the option is an American option, A exercises it on May 15 and sells the copper at a profit of $300 per tonne.

European options are options that can be exercised only on the expiration date itself.

European options are easier to analyze than American options, and properties of an American option are frequently deduced from those of its European counterpart.

European options are easier to value than American options because the analysts need only be concerned about their value at one future date.

Both European and American options have the same value. Because of their relative simplicity and because of the understanding of European options, valuation is often the springboard to understanding the process of valuing the more popular American options.

For example, all the other facts are as above, but an option is a European option. In this case, A cannot exercise the option on May 15 because he only has the right to do so on the maturity date.

He, therefore, does not have the profit opportunity that he had in the previous example.

It will be clear that an American option has a greater profit potential than a European option for the buyer. This leads to premia being higher for American options.

In-the-Money (ITM)/At-the-Money (ATM)/Out-the-Money (OTM) Option

An In-the-Money (ITM) option is an option that would lead to positive cash flow to the holder if it were exercised immediately.

A call option on the index is said to be in the money when the current index stands at a level higher than the strike price (i.e., spot price > strike price).

If the index is much higher than the strike price, the call is said to be deep ITM. In the case of a put, the put is ITM if the index is below the strike price.

An At-the-Money (ATM) option is an option that would lead to zero cash flow if it were exercised immediately.

An option on the index is at-the-money when the current index equals the strike price [i.e., spot price (St) = strike price (K)].

An Out-of-the-Money (OTM) option is an option that would lead to a negative cash flow if it were exercised immediately.

A call option on the index is out-of-the-money when the current index stands at a level that is less than the strike price (i.e., spot price c strike priced.

If the index is much lower than the strike price, the call is said to be deep OTM. In the case of a put, the put is OTM if the index is above the strike price.

Example 3: Three put options A, B, and C with strike prices of Rs. 100, Rs. 105, and Rs. 110 are selling at Rs. 2, Rs. 5, and Rs. 13, respectively, when the underlying stock is trading at Rs. 105.

1. Find out which of the put options are ITMV ATM and OTM.

2. If the price of each of the put options increases by Rs. 1, would your answer to the moneyness of options change?

3. If the price of each of the options decreases by Rs. 1, what would be the change in the moneyness of each of the options?

Solution:

1. Moneyness of put options is as under:

Option A: X – S = 100 – 105 = Negative; Out-of-the-money by Rs. 5

Option B: X – S = 105 – 105 = Zero; At-the-money

Option C: X – S = 110 — 105 = Positive; In-the-money by Rs. 5

2. and 3. If the price increases or decreases, there would be no change in die moneyness of options. Premium paid is a sunk cost.