A commodity swap is a swap where exchanged cash flows are dependent on the price of an underlying commodity.

This is usually used to hedge against the price of a commodity. A commodity swap is an agreement whereby a floating (or market or spot) price is exchanged for a fixed price over a specified period.

In this swap, the user of a commodity would secure a maximum price and agree to pay a financial institution this fixed price.

Then in return, the user would get payments based on the market price for the commodity involved.

On the other hand, a producer wishes to fix his income and would agree to pay the market price to a financial institution in return for receiving fixed payments for the commodity.

In commodity swaps, the cash flows to be exchanged are linked to commodity prices.

Commodities are physical assets such as metals, energy, and agriculture.

For example, in a commodity swap, a party may agree to exchange cash flows linked to the prices of oil for a fixed cash flow.

Commodity swaps are used for hedging against fluctuations in commodity prices or fluctuations in spreads between the final product and raw material prices, e.g., a cracking spread which indicates the spread between crude prices and refined product prices significantly affects the margins of oil refineries.

Commodity swaps involve two participants, called counter-parties.

Swaps are done through a contract or agreement to exchange cash flows dependent upon the price of a given commodity.

On pre-determined “settlement dates,” or dates on which the commodity price is recorded, cash-flow exchanges between the parties take place.

The type of commodity swap entered will depend upon the investment strategy, specifically whether a party is an “end-user,” such as a producer or consumer of the commodity or a speculator attempting to make money from price fluctuations.

Types of Commodity Swaps

There are two types of commodity swaps:

Fixed-Floating Swaps

Fixed-floating swaps are just like the fixed-floating swaps in the interest rate swap market, with the exception that both indices are commodity-based indices.

General market indices in the commodities market with which many people would be familiar to include the Goldman Sachs Commodities Index (GSCI) and the Commodities Research Board Index (CRBI).

These two indices place different weights on the various commodities, so they will be used according to the swap agent’s requirements.

Commodity-for-interest Swaps

Commodity-for-interest swaps are similar to the equity swap in which a total return on the commodity in question is exchanged for some money market rate (plus or minus a spread).

Structure of Commodity Swap

Commodity swaps involve two participants, called counter-parties.

Swaps are done through a contract or agreement to exchange cash flows dependent upon the price of a given commodity.

On pre-determined settlement dates or dates on which the commodity price is recorded, cash-flow exchanges between the parties take place.

The type of commodity swap entered will depend upon the investment strategy, specifically whether a party is an “end-user,” such as a producer or consumer of the commodity or a speculator attempting to make money from price fluctuations.

In a commodity swap, the first counterparty makes periodic payments to the second at a per-unit fixed price for a given quantity of some commodity.

The second counterparty pays the first a per unit floating price (usually an average price based on periodic observations of the spot price) for a given quantity of some commodity.

The commodities may be the same (the usual case) or different. As a general rule, no exchanges of nationals take place – all transactions in actuals take place in the cash markets.

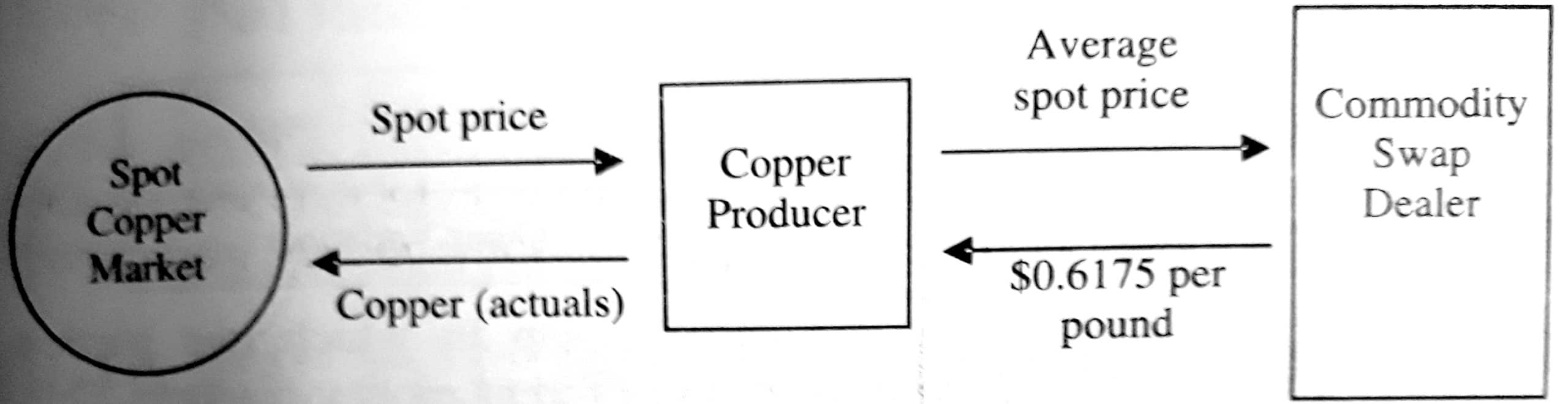

Consider a simple case – a copper producer wants to fix the price it receives for its copper output for six years.

Suppose that its monthly production averages 3 million pounds. To obtain the desired outcome, the copper producer enters into a swap with a commodity swap dealer but continues its transactions in actuals in the cash markets.

At the time this firm enters the swap, the commodity swap dealer’s mid-price for copper is $0,620 per pound.

To this, the dealer adds $0.0025 per pound if it is a fixed-price receiver and deducts $0.0025 if it is a fixed’ price payer.

In either case, the floating-price side is determined by an average of weekly observations on the spot price of copper.

Given the dealer’s pricing, the copper producer can expect to receive $0.6175 per pound of copper and to pay the average spot price for the month.

As can be seen in figure 6.10, these payments have the effect of fixing the price of copper for the copper producer:

To the extent that the dealer has an imbalance in the copper portion of its commodity swap book, the dealer will hedge in copper futures.

Valuing Commodity Swaps

In pricing commodity swaps, one can think of the swap as a strip of forwards, each priced at inception with zero market value (in a present value sense).

Thinking of a swap as a strip of at-the-money forwards is also a useful, intuitive way of interpreting interest rate swaps or equity swaps.

Commodity swaps are characterized by some idiosyncratic peculiarities, though.

These include the following factors for which one must account (at a minimum):

- The cost of hedging;

- The institutional structure of the particular commodity market in question;

- The liquidity of the underlying commodity market;

- Seasonality and its effects on the underlying commodity market;

- The variability of the futures bid/offer spread;

- Brokerage fees; and

- Credit risk, capital costs, and administrative costs.v

Some of these factors must be extended to the pricing and hedging of interest rate swaps, currency swaps, and equity swaps as well.

The idiosyncratic nature of the commodity markets refers more to the often limited number of participants in these markets (naturally begging questions of liquidity and market information), the unique factors driving these markets, the interrelations with cognate markets, and the individual participants in these markets.