An interest rate swap, or simply a rate swap, is an agreement between two parties to exchange a series of interest payments without exchanging the underlying debt.

In a typical fixed/floating rate swap, the first party promises to pay to the second at designated intervals a stipulated amount of interest calculated at a fixed rate on the “notional principal”; the second part promises to pay to the first at the same intervals a floating amount of interest on the notional principal calculated according to a floating-rate index.

The first party in a fixed/floating rate swap, which pays the fixed amount of interest, is known as the fixed-rate payer, while the second party, which pays the fixed amount of interest, is known as the floating-rate payer.

The notional principal is simply a reference amount against which the interest is calculated.

Interest rate swaps can be used to take on fresh interest rate risk as well as to manage existing interest rate risk.

Interest rate swaps without offsetting underlying create interest rate risk.

Each counterparty in an interest rate swap is committed to pay a stream of interest payments and receive a different stream of interest payments.

A payer of fixed interest rate payments is exposed to the risk of falling interest rates, while a payer of floating interest rate payments is exposed to the risk of rising interest rates.

Similarly, a receiver of fixed interest rate payments is exposed to the risk of rising interest rates, while the receiver of floating interest payments is exposed to the risk of falling interest rates.

In conclusion, interest rate swaps create an exposure to interest rate movements, if not offset by an underlying exposure.

Features of Interest Rate Swap

Following are the features of an interest rate swap:

- It is treated as an off-the-balance sheet transaction.

- It is structured as a separate contract distinct from the underlying^ loan agreement.

- There is no exchange of principal repayment obligations.

- It effectively translates floating rate borrowing into fixed-rate borrowing and vice versa.

- The motivation of interest rate swap is to save interest costs.

- Interest Rate Swaps suffers from credit risk to the extent of interest ‘ payments. However, there is no risk on the principal amounts, since principals are not exchanged.

- In exchange, the party receiving the fixed rate agrees to pay the other party cash flows equal to interest at a floating rate on the same notional principal for the same period of time.

Reasons for Using Interest Rate Swaps

Interest rate swaps are used by a wide range of commercial banks, investment banks, non-financial operating companies, insurance companies, mortgage companies, investment vehicles and trusts, government agencies, and sovereign states for one or more of the following reasons:

- To hedge interest rate exposure;

- To take speculative positions in relation to future movements 8 interest rates;

- To lower the cost of funding;

- To create new types of investment assets not otherwise available; and

- To implement the overall assets-liability management strategies.

Types of Interest Rate Swaps

Following are the types of interest rate swaps:

Plain Vanilla Swap

Plain vanilla swap is also known as a fixed-for-floating swap. In this swap, one party with a floating interest rate liability is exchanged with fixed-rate liability.

Usually swap period ranges from 2 years to over 15 years for a predetermined notional principal amount. Most deals occur within four years period.

Zero Coupons to Floating

The holders of zero-coupon bonds get the full amount of loan and interest accrued at the maturity of the bond.

Hence, in this swap, the fix^d rate player makes a bullet payment at the end and the floating rate player makes the periodic payment throughout the swap period.

Alternative Floating Rate

In this type of swap, the floating reference can be switched to other alternatives as per the requirement of the counter-party.

These alternatives include a three-month MIBOR, one-month commercial paper, T-Bill rate, etc. In other words, alternative floating interest rates are charged in order to meet the exposure of another party.

Floating-to-Floating Swap

In this swap, one counterparty pays one floating rate, such as LIBOR while the other counterparty pays another, such as prime for a specified time period.

These swap deals are mainly used by non-US banks to manage their dollar exposure.

Forward Swap

This swap involves an exchange of interest rate payment that does not begin until a specified future point in time.

It is also a kind of swap involving fixed floating interest rates.

Rate-Capped Swap

In this type of swap, there is an exchange of fixed-rate payments for floating-rate payments, whereby the floating rate payments are capped.

An upfront fee is paid by a floating-rate party to a fixed-rate party for the cap.

LIBOR

London Interbank Offered Rate (LIBOR) quoted by a particular bank is the rate of interest at which the bank is prepared to make a large wholesale deposit with other banks.

Large banks and other financial institutions quote LIBOR in all major currencies for maturities up to 12 months: 1-month LIBOR is the rate, at which 1-month deposits are offered, 3-month LIBOR is the rate at which 3-month deposits are offered, and so on.

A deposit with a bank can be regarded as a loan to that bank. A bank must therefore satisfy certain creditworthiness criteria in order 1 to be able to accept a LIBOR quote from another bank so that 11 receives deposits from that bank at LIBOR. Typically it must have a AA credit rating.

MIBOR

The interest rate at which banks can borrow funds, marketable size, from other banks in the Indian interbank market.

The Mumbai Interbank Offered Rate (MIBOR) is calculated every day by the National Stock Exchange of India (NSEIL) as a weighted average of lending rates of a group of banks, on funds lent to first-class borrowers.

Structure of Interest Rate Swaps

The most common form of swap is the interest rate swap. An interest I rate swap represents a derivative product.

When two parties agree to an interest rate swap, they are trading interest rate arrangements.

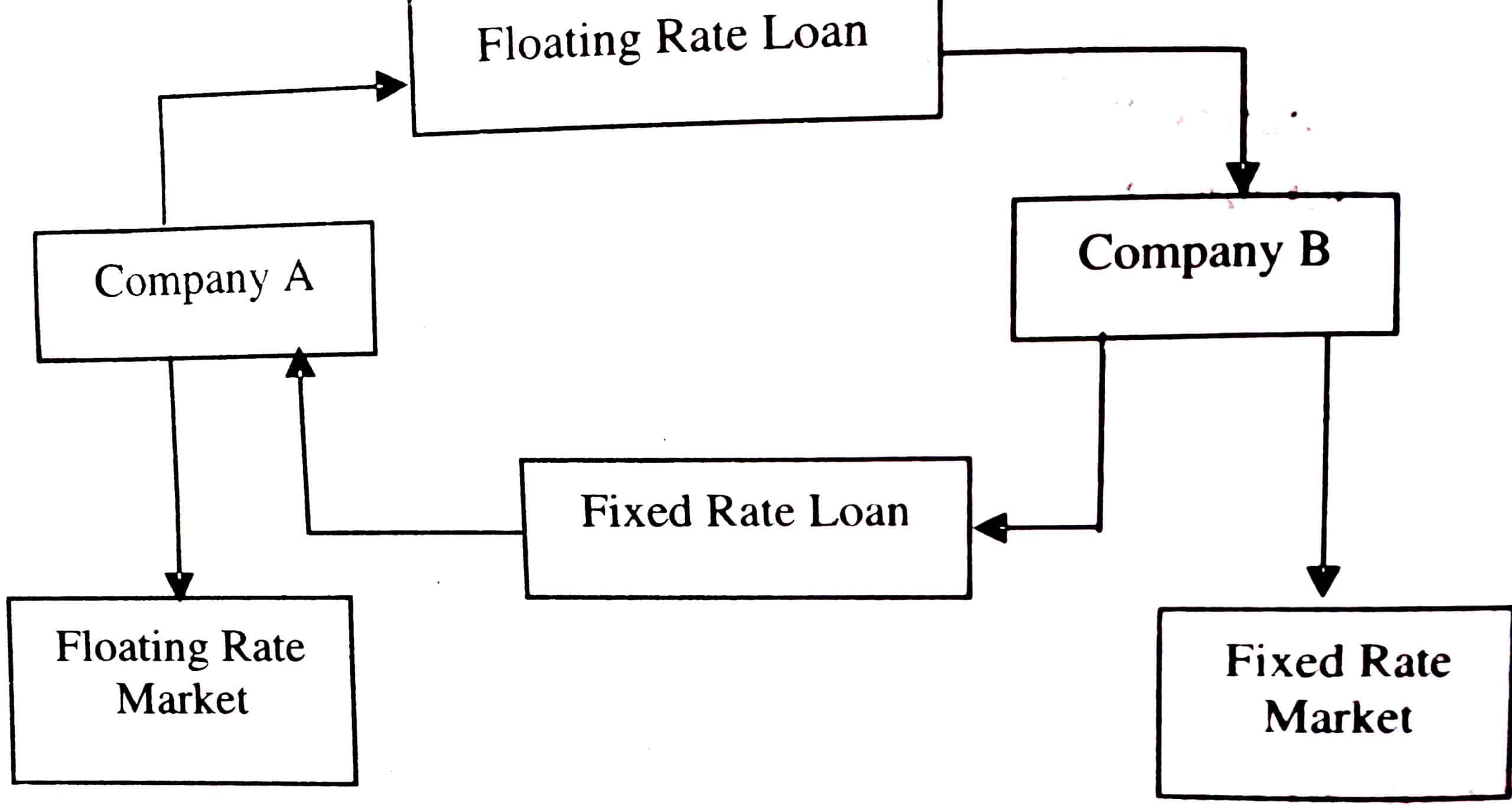

In an interest rate swap, a fixed interest rate loan is exchanged for a floating interest rate loan.

The figure given below illustrates the basic structure of this form of a swap when one company transacts a swap in order to hedge its floating-rate loans:

The company takes out a floating rate loan with the base rate adjusted to the three-month bill rate.

Since the actual interest amount will depend on the three-month bill rate, the interest amount will vary.

To hedge this variability in the interest payments, the company swaps the floating-rate loan with a swap counterparty for a fixed-rate loan, which would provide a constant interest rate during the life of the loan.

Suppose the swap has a two-year maturity; then, an exchange of the current two-year swap rate for the market’s three-month bill rate will occur every three months for the next two years.

For example, assume that the two-year swap rate is 9% at the start of the swap arrangement and the three-month bill rate is 8%.

This means that the company will pay 0.25% of the notional principal at the end of the first three months.

Note that the principal is not exchanged in an interest rate swap.

Since the company is swapping a floating rate loan for a fixed-rate loan, the company will need to pay 9% for the three-month loan under the swap, whereas the floating-rate loan would have cost only 8%.

Thus, the company has to pay 1% higher interest on a yearly basis, or 0.25% on a three-month basis to the swap counterparty.

After three months, assume that the three-month bill rate increases to 10%. Since the fixed rate is 9%, the swap counterparty will pay the company 0.25% of the notional principal at the end of six months.

This additional payment from the swap counterparty will provide sufficient funds to pay the interest on the floating rate loan at 10%.

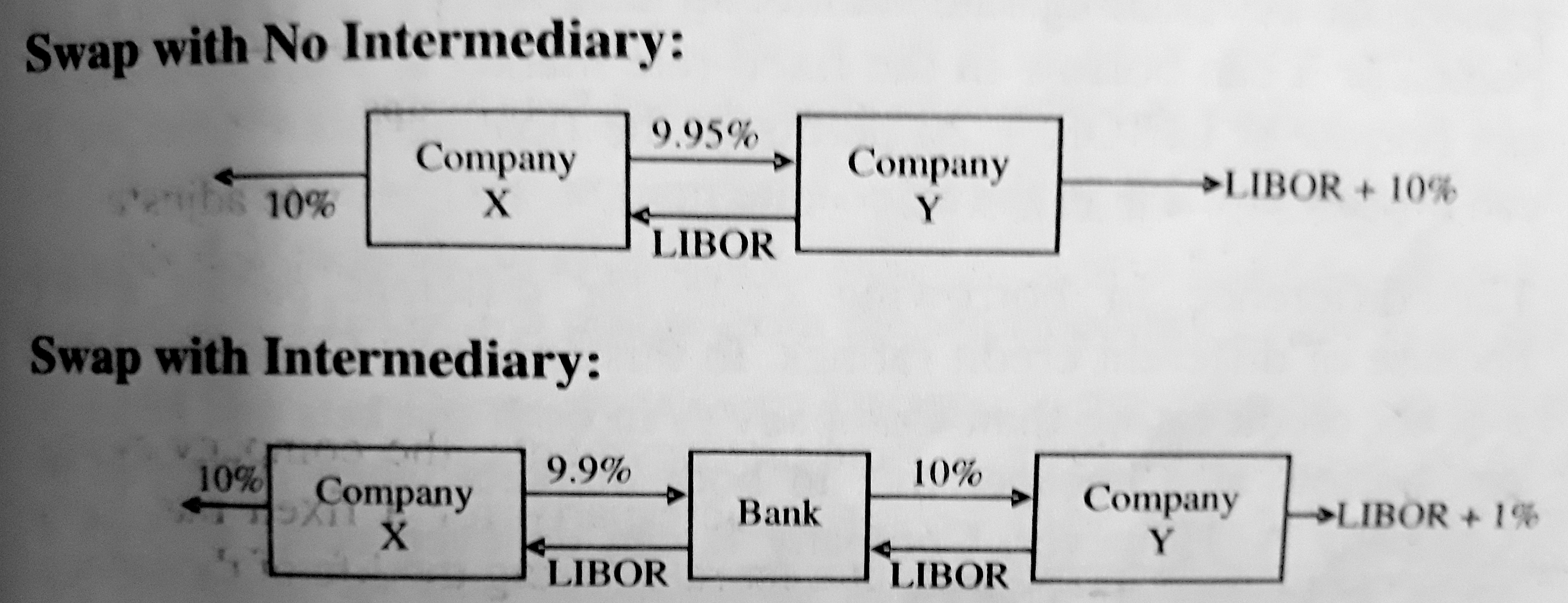

Example 2: Company X and Y both wish to borrow Rs. 10 crores for 5 years. Company Y wants to arrange a floating rate loan.

The rate is a six-month LIBOR. Company Y wants to arrange a fixed-rate loan. They have been offered the following terms:

| Fixed-Rate | Floating Rate | |

| Company X | 10.0% | Six-month LIBOR +0.3% |

| Company Y | 11.2% | Six-month LIBOR +1.0% |

Show the transaction without an intermediary and with an intermediary.

Solution: These transactions show that:

- Company X borrows fixed-rate funds at 10% per annum.

- Company Y borrows floating rate funds at LIBOR + 1.0% per annum.

- They enter into a swap agreement.

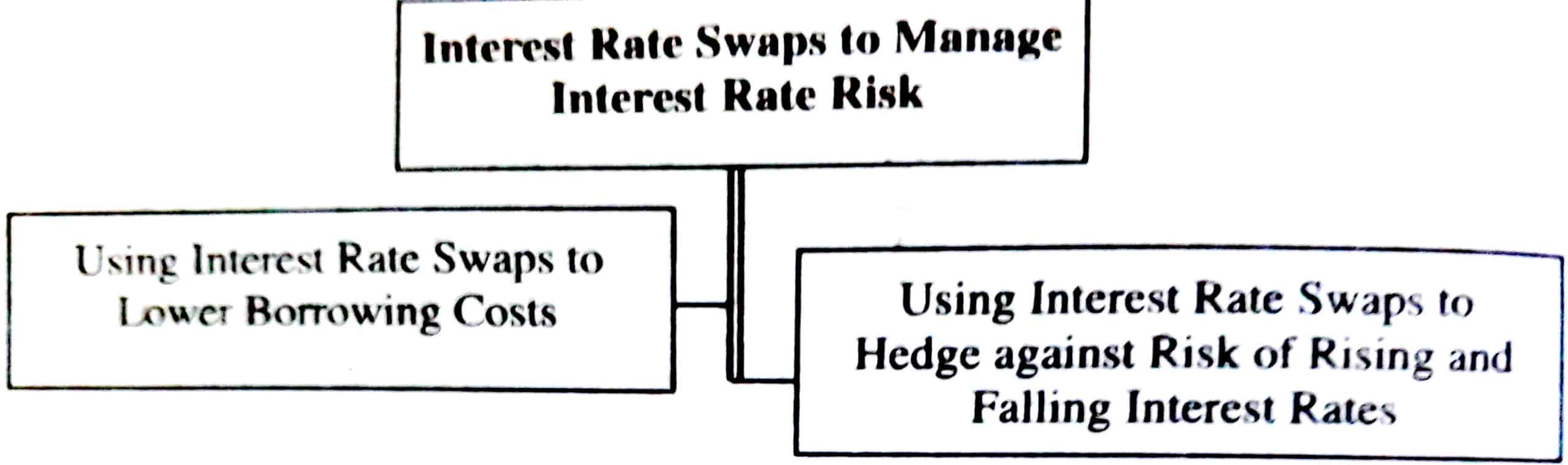

Interest Rate Swaps to Manage Interest Rate Risk

Following are the ways by which interest rate risks are managed interest rate swap:

Using Interest Rate Swaps to Lower Borrowing Costs

Interest rate swaps are voluntary market transactions by two parties.

In an interest swap, as in all economic transactions, it is presumed that both parties obtain economic benefits.

The economic benefits of an interest rate swap are a result of the principle of comparative advantage.

Further, in the absence of national and international money and capital market imperfections and in the absence of comparative advantages among different borrowers in these markets, there would be no economic incentive for any firm to engage in an interest rate swap.

Interest rate swaps generally involve two firms with different credit ratings.

A Quality Spread Differential (QSD) is observed to exist at different maturities for firm debts with different credit ratings.

The quality spread differential allows two firms with different credit ratings to decrease their borrowing costs through interest rate swaps by utilizing their comparative advantage in borrowing in different markets.

The credit ratings of firms are determined by credit risk factors such as leverage and volatility of earnings asset value.

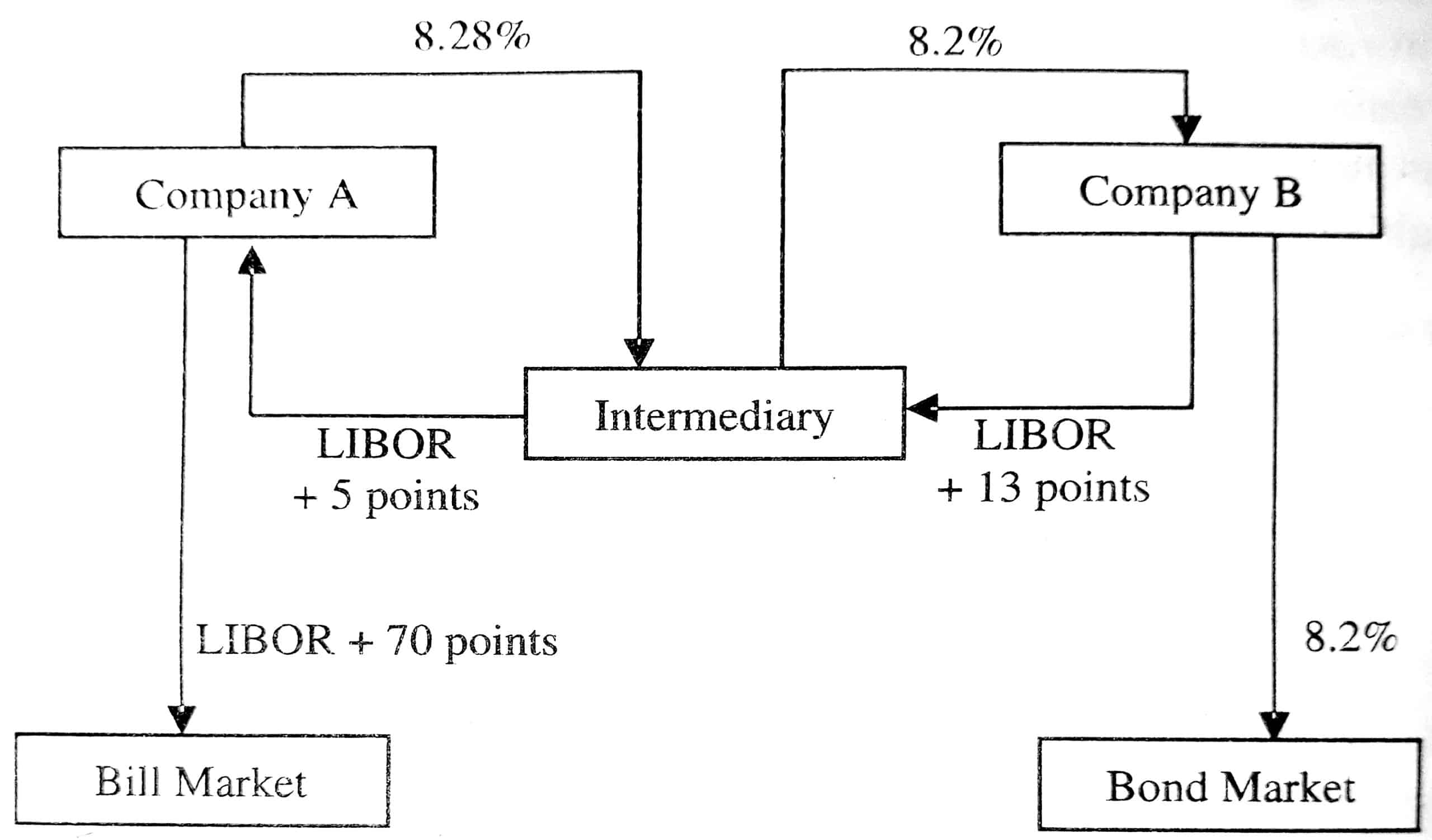

For example, Company A is seeking to raise funds for a three-year period. In the floating-rate market, it can borrow at LIBOR + 70 points, or it can borrow in the fixed-rate market at 9%.

Company B can borrow at LIBOR + 20 points in the floating-rate market, or it can borrow at 8.2% in the fixed-rate market.

This difference in borrowing costs for different parties arises because of different credit ratings. In this example.

Company B has a better credit rating than Company A in both markets and hence it can borrow at a cheaper rate in both markets when compared to Company A.

However, Company B can do even better through a swap arrangement. The swap arrangement will be based on the comparative advantage that a company has over the other in a particular market.

In this example. Company B has a comparative advantage over Company A in the fixed-rate market, while Company A has a comparative advantage over Company B in the floating-rate market, as shown in the table below:

| Market | Company A | Company B | Margin |

| Floating rate points | LIBOR + 70 points | LIBOR + 20 points | 50 |

| Fixed-rate points | 9% | 8.2% | 80 |

Company B has an advantage of 80 points over Company A in the fixed-rate market, whereas it has an advantage of only 50 points in the floating-rate market, for a net difference of 30 points.

Assuming that the intermediary charges 8 points from each of the parties, the total gain of 30 points is shared as 16 points to the intermediary, 7 points to Company B, and 7 points to Company A, and the swap design will be as shown in the figure given below:

Company A

Pay LIBOR + 70 points in the bill market

Pay 8.28% to the intermediary

Receive LIBOR + 5 points from the intermediary

Net Rate for Company A = [(LIBOR g 0.7%) + 8.28 – (LIBOR 0.05%)] = 8.93%

Net Gain for Company A = 9% – 8.93% = 0.07% or 7 points

Company B

Pay 8.2% in the bond market

Receive 812%’ from the intermediary

Pay LIBOR +13 points to the intermediary

Net Rate for Company B = (LIBOR + 0.13% + 8.2% – 8.2%) I LIBOR+ 0.13%

Net Gain for Company B = (LIBOR + 20 points) – (LIBOR + 13 points) = 7 points

Intermediary

Pay 8.2% to Company B

Receive 8.28% from Company A

Pay LIBOR + 0.05% to Company A

Receive LIBOR + 0.13% from Company B

Net Receipt = (LIBOR + 0.13%) – (LIBOR + 0.05%) + 8.28% 8.2% = 0.16% = 16 points

Using Interest Rate Swaps to Hedge against Risk of Rising and Falling Interest Rates

Interest rate swaps are used to hedge interest rate risks as well as to take on interest rate risks.

If a treasurer is of the view that interest rates will be falling in the future, he may convert his fixed interest liability into floating interest liability; and also his floating-rate assets into fixed-rate assets.

If he expects the interest rates to go up in the future, he may do vice versa. Since there are no movements of principal, these are off-balance sheet instruments and the capital requirements on these instruments are minimal.

Hedge against Risk of Rising Interest Rates

Interest rate swaps without offsetting underlying create interest rate risk.

Each counterparty in an interest rate swap is committed to pay a stream of interest payments and receive a different stream of interest payments.

A payer of fixed interest rate payments is exposed to the risk of falling interest rates.

Similarly, a receiver of fixed interest rate payments is exposed to the risk of rising interest rates.

Floating rate loans expose the debtor to the risk of increasing interest rates.

To avoid this risk, he may like to go for a fixed-rate loan, but due to the market conditions and his credit rating, his fixed-rate loans are available only at a very high cost.

In that case, he can go for a floating rate liability and then swap the floating rate liability into a fixed rate liability.

He can do the swap with another counterparty whose requirements are the exact opposite of his or, as is more often the case, can do the swap with a bank.

Hedge against Risk of Falling Interest Rates

A payer of floating interest rate payments is exposed to the risk of rising interest rates.

Similarly, a receiver of floating interest payments is exposed to the risk of falling interest rates.

To summarize, interest rate swaps create an exposure to interest rate movements, if not offset by an underlying exposure.

Borrower A has a floating-rate loan but would prefer a fixed-rate loan. There is another borrower B who has a fixed-rate loan but would prefer a floating-rate loan.

The intermediary can now match these two borrowers.

For example, G Ltd. has an existing fixed-rate liability. It feels that interest rates are going to fall (which will raise the capitalized value of the debt) and wishes to hedge against this.

H Ltd. has an existing floating rate liability but expects the interest rate to rise, increasing its interest burden. It wishes to hedge against this.

G and H enter into a swap through broker M whereby G becomes the floating rate payer and H the fixed ratepayer in a swap.

Assume that the interest rate falls as anticipated by G. Its payment under the swap decreases as the floating rate falls, while its receipt remains unchanged.

There is a positive cash flow that offsets the increase in the value of the fixed-rate debt. As for H, the fall in rates reduces its receipt under the swap while leaving its payment unchanged.

There is a negative cash flow in the swap, which offsets H’s gain in the cash market. On the other hand, if the interest rate rises (as anticipated by H), G’s payment under the swap increases, with its receipt unchanged.

The resulting negative swap cash offsets the reduction in the value of the cash market liability.

For the rise in interest rates means an increased receipt under the swap with unchanged payments. The resulting positive cash flow offsets H’s loss in the cash market.

Example 3: Five years ago Blackstone Corp had raised a loan through 10-year-old debenture issue worth Rs. 100 crores with a fixed interest rate of 12%.

After the issue, the interest rate remained constant for some time. But now they have been around 10% and are likely to come down further. Blackstone Corp. wishes to contain the cost of funding for the remaining five years.

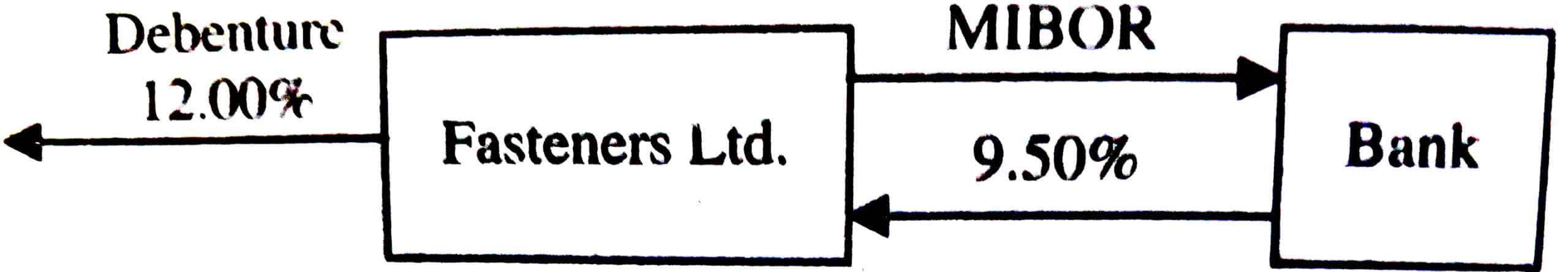

A bank has offered a swap rate of 9.50% against MIBOR for a period of 5 years. Depict the swap arrangement and find out the new nature of liabilities the firm can have.

Solution: Blackstone Corp. has liability on a fixed interest of 12%. By entering a swap with the bank it may transform the liability from a fixed rate to a floating rate based on MIBOR. Under the swap arrangement, Blackstone Corp. can receive fixed and pay MIBOR.

The bid fate of the swap (9.50%) would be applicable.

The cost of funds for Blackstone Corp. would be = 12.00% – 9.50% + MIBOR = MIBOR + 2.50%.

In case interest rates fall below 9.50%, which is expected, the firm would end up paying lesser interest than what it is paying now.

The interest rate payable would be market based.

Existing Payment = 12%

But New Payment = MIBOR + 2.50% = Less than 9.50% + 2.50% = Less than 12%