Swaps are bilateral agreements between two parties, called counterparties, in which the parties agree to make a series of payments to each other.

This agreement or contract is evidenced by a document called a master swap agreement.

All swaps regardless of type, arc founded on the same basic structure. First, some “notional” amount is specified at the time the swap is written.

This notional amount may be a notional principal (as it is in the case of interest rate, currency, and equity swaps), or notional commodities (as it is in the case of commodity swaps).

The notional principals on swaps are generally not exchanged, but the counterparties to a swap do exchange “service” payments.

The service payments are made at designated intervals over the life of the swap. The life of the swap is called its tenor.

The service payments are typically structured so that one party pays a fixed price and the other pays a floating price determined by some index to which the floating price is pegged.

The two sides of such swaps are called the fixed leg and floating leg of the swap, respectively.

In most swaps, the prices take the form of rates; therefore, the legs are called the fixed-rate leg and the floating-rate leg.

The fixed rate is often called the swap coupon. Swaps can also be engineered to have two floating legs or two fixed legs.

Though not essential, most swaps are affected between an end-user and a swap dealer rather than directly between two end-users.

Swap dealers add liquidity to swap markets by eliminating the need to precisely match all the provisions of swaps between end-users.

For their services, swap dealers earn a bid-ask spread (often called a pay-receive spread) and sometimes collect front-end fees when complex financial engineering is involved; they may collect a premium if the swap has an option or option-like component.

The notionals on a swap are not usually exchanged. They exist only for purposes of calculating the size of the service payments.

The term notional is meant to distinguish between the underlying asset of a swap and the real asset exchanged in the cash markets.

The latter is called actuals, ignoring the initial and terminal exchanges of notionals, which may or may not be required depending on the purpose of the swap; the basic swap structure is easily described using a boxed cash flow form of illustration.

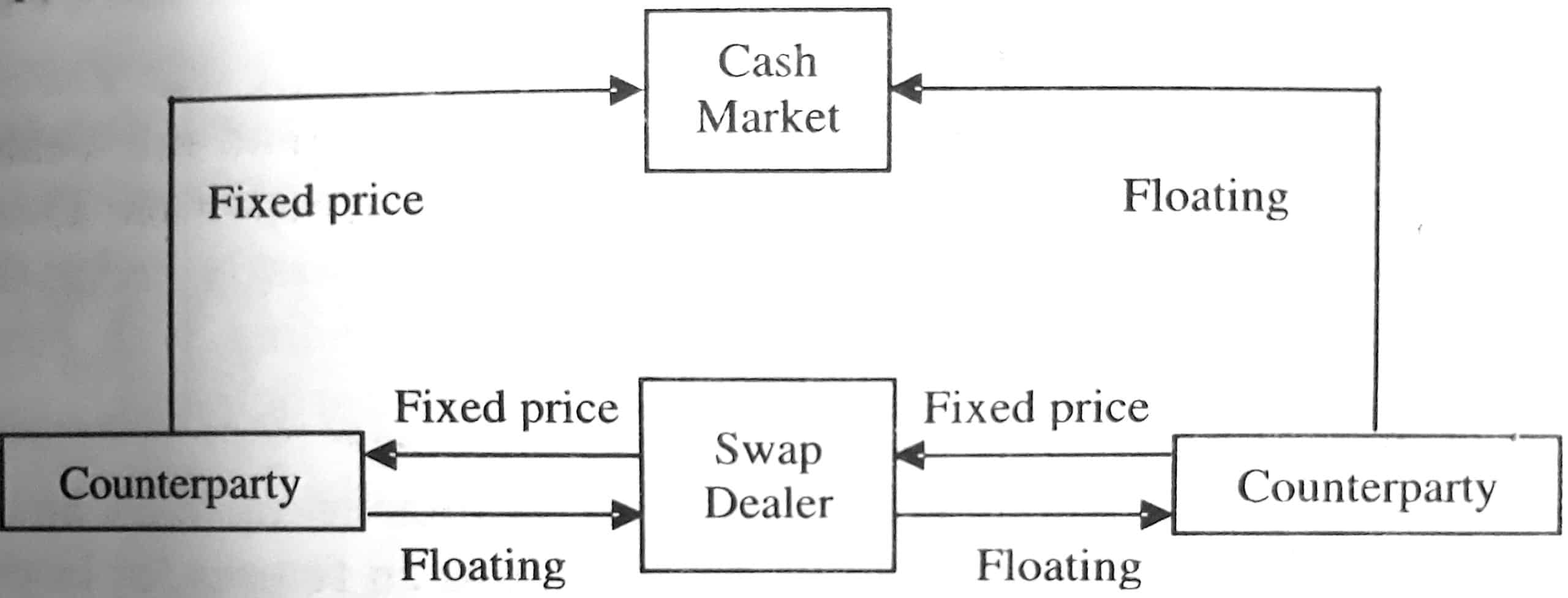

Two “plain vanilla” swaps with the swap dealer standing between the end-users are illustrated in the figure given above together with the accompanying cash market transactions.

As this figure given above shows, the swap converts counterparty A’s fixed price obligation to a floating-price obligation and converts counterparty B’s float mg-price obligation to a fixed-price obligation.

If the cash markets of the two end-users are the same, then the swap can be used to convert floating prices to fixed prices for both end-users.