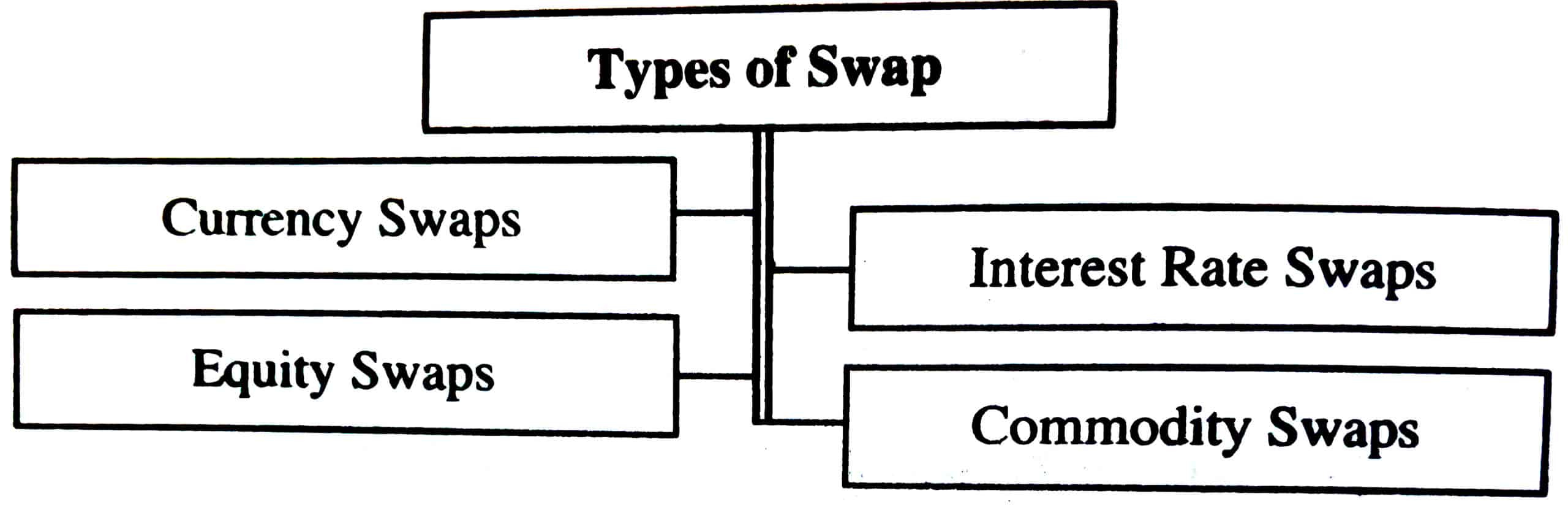

Following are the types of swap:

Currency Swaps

Swap contracts also can be arranged across currencies.

Such contracts are known as currency swaps and can help to manage both interest rate and exchange rate risk.

A currency swap is an agreement between two parties to exchange a given amount in one currency for another and to repay these currencies with interest in the future.

A currency swap is a foreign exchange agreement between two parties to exchange a given amount of one currency for another and, after a specified period of time, to give back the original amounts swapped.

Interest Rate Swaps

A standard fixed-to-floating interest rate swap, known in the market terminology as a Plain Vanilla Coupon Swap (exchange borrowings), is an agreement between two parties in which each contract to make payments to the other on particular dates in the future till a specified termination date.

Equity Swaps

Under an equity swap, the shareholder effectively sells his holdings to a bank, promising to buy it back at the market price at a future date. However, he retains voting right on the shares.

Inequity swap, at least one of the two streams of cash flows is determined by a stock price, the value of a stock portfolio, or the level of a stock index.

The other stream of cash flows can be a fixed rate, a floating rate such as MIBOR, or it can be determined by the value of another stock, stock portfolio, or stock index.

In this manner, an equity swap can substitute for trading in an individual stock, stock portfolio, or stock index.

Commodity Swaps

In commodity swaps, the cash flows to be exchanged are linked to commodity prices. Commodities are physical assets such as metals, energy stores, and food, including cattle.

For example, in a commodity swap, a party may agree to exchange cash flows linked to the prices of oil for a fixed cash flow.

Commodity swaps are used for hedging against:

- Fluctuations in commodity prices, of

- Fluctuations in spreads between the final product and raw material prices, e.g., cracking spread, which indicates the spread between crude prices and refined product prices, significantly affect the margins of oil refineries.

A company that uses commodities as input may find its profits becoming very volatile if the commodity prices become volatile.

This is particularly so when the output prices may not change as frequently as the commodity prices change.

In such cases, the company would enter into a swap, whereby it receives payment linked to commodity prices and pays a fixed rate in exchange.

A producer of a commodity may want to reduce the variability of his revenues by being a receiver of a fixed rate in exchange for a rate linked to the commodity prices.